A...

Lynx empowers financial institutions with advanced AI to protect customers. Our advanced models set industry standards, offering real-time defenses against evolving fraud and financial crimes.

Transactions

%

Global transactions secured annually

%

%

%

%

%

The Gartner Market Guide for fraud detection in banking payments

Customer Success Stories

The increasingly complex threat landscape requires decisive, real-time action. Our customers rely on Lynx’s innovative solutions to protect their clients and maintain trust. Hear directly from those who partner with us:

“Lynx provides us a powerful tool to have an effective response to fraud in milliseconds.”

Hazel Diez Castaño,

Global Chief Information Security Officer

“Thanks to Lynx, we are taking decisions in real time to stop fraud.”

David Penedo

Global Head of Fraud Prevention

Discover How Lynx Can Transform Your Institution’s Defense

Lynx Fraud Prevention

Protect against various forms of fraud, including identity theft, scams, ATO and APPF, using adaptive models to analyze real-time anomalies.

Lynx AML

Streamline operations to ensure regulatory compliance while reducing false positives and deliver a faster return on investment.

Lynx Money Mule Account Detection

Detect illicit funds and accounts in real-time, preventing illegal transactions from leaving your institution.

At Lynx, we are committed to leading the fight against fraud and financial crime through advanced AI technologies, continuous innovation, and deep industry expertise. With a keen focus on our clients’ issues, we leverage insight to empathize with both the threats we face and their unique needs.

With Lynx’s watchful eye on AI, we ensure that our clients remain steps ahead of emerging threats. We empower financial institutions to build trust, uphold the integrity of macroeconomic systems, and protect consumers. Together, we safeguard the financial landscape for a secure tomorrow.

A Tier 1 financial institution achieved a 700% improvement in money mule detection rate, and a 35% increase in scam detection.

Another major institution recorded a 65% annual detection rate (ADR) and 70% value detection rate (VDR), with only 10 false positives per 10K transactions.

A leading UK bank realized a 35% improvement in overall fraud detection effectiveness.

Cielo operates the largest payment processor in LATAM, processing +11 billion transactions per year.

“We chose Lynx for its advanced AI and unmatched accuracy in predicting and identifying fraud.”

— Cielo

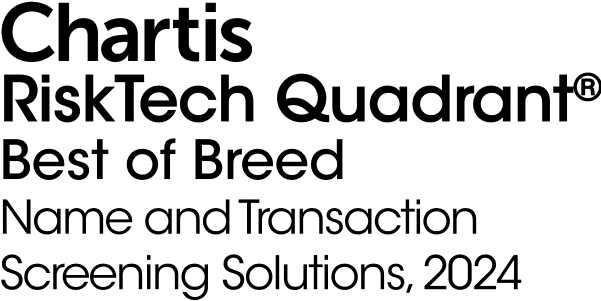

Recognition

Lynx is a recognised leader in the detection and prevention of fraud and financial crime.

Gartner, Market Guide for Fraud Detection in Banking Payments, 11 December 2024, Pete Redshaw

GARTNER is a trademark of Gartner, Inc. and/or its affiliates. Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s Research & Advisory organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

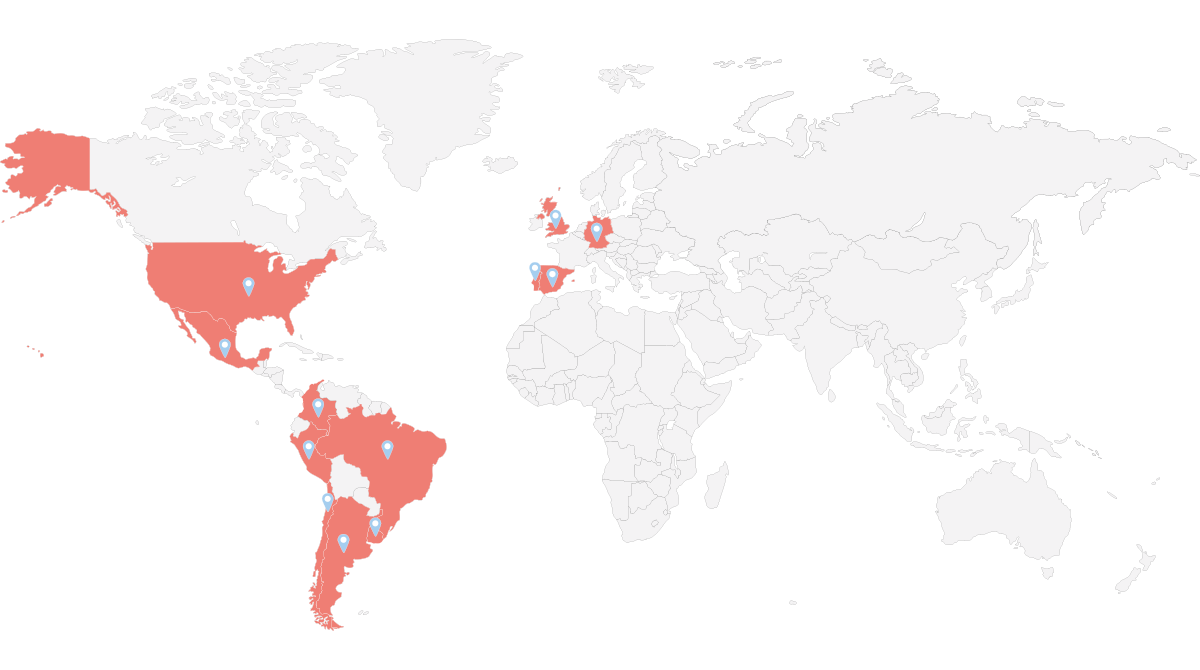

Lynx is trusted by multinational organizations across the globe. We detect and prevent fraud and financial crime with unmatched speed, accuracy, and expertise.

Access our articles, white papers, and insights to understand how Lynx empowers financial institutions every day.

Lynx Tech Welcomes Venancio Gallego Vindel as New CEO of Lynx Financial Crime

Lynx is recognized in the Top 50 of Chartis’ “Retail Banking Analytics50” report

Beyond the Transaction: Why Fraud Vigilance Is Essential for Stability

Lynx, awarded at the PAY360 Awards as Best Initiative in Utilising Data or AI

Lynx Tech is recognized by Gartner® in its 2025 Market Guide for Anti-Money Laundering

What is Causing the Rapid Rise in Fraud?

IA vs Money Laundering

How Argentina’s Policy Impacts AML Controls