About us

AI against Fraud &

Financial Crime

Lynx was born to lead the fight against Fraud and Financial Crime through advanced AI Technologies, continuous innovation and deep industry expertise.

Lynx

culture

Recognized Excellence

“Lynx’s appearance in our inaugural FCC50 ranking reflects an ability to transition its knowhow and standing in the area of fraud detection into AML and beyond,”

“Alongside a robust platform that incorporates a large number of risk signals and enables high scalability and flexibility, Lynx’s sophisticated modeling and tuning capabilities, underpinned by an AI-first approach, enable it to solve challenges in some of the most complex use cases and markets.”

Nick Vitchev – Research Director at Chartis.

We are leading with continuous innovation, outstanding customer experience, and operational excellence

Our guiding values

1

Continuous innovation sees us through the future

Technology is at the core of our vision, driving us to constantly search, learn, evolve, and continuously innovate in order to lead the way. Our expertise in Data Science means we’re curious and constantly exploring new ways to innovate with AI in Fraud and AML.

2

Exceptional customer commitment

Our pursuit of excellence is never-ending, as we seek to continuously enhance our offerings and provide exceptional customer experiences. We approach every challenge with curiosity and determination, believing that no obstacle is too great to overcome.

3

Agile & ready to act

Our extensive experience in AI technology for Fraud and Financial Crime spans over two decades, providing us with the in-depth knowledge and expertise that distinguishes us in the industry. Our solutions empower customers to cut costs and achieve faster time to value.

4

Transparency & integrity, doing the right thing

We remain grounded in our beliefs, always embracing our humanity and keeping our minds open to new ideas and perspectives. Our unwavering loyalty to our customers drives us to always do what is right.

Team

Unquestioning growth,

and never alone

It’s all about people, about the relationship between technology, talent and excellence.

Global Business Leader, passionate about technology, AI, Fraud & Financial Crime, and Cybersecurity.

I have dedicated my career to building and leading successful companies, focused on revenue growth, technology innovation and delivering excellence in customer experience. I also share my passion for technology and my global experience as an active business advisor and a member on several boards.

Prior to Lynx, I lead the global revenue growth strategy at OneSpan Inc, a Nasdaq listed company specialized in intelligent authentication software. The transformational journey at OneSpan over 15 years, helped me build great teams across the globe, create material value for the company and enhance my skills in strategic leadership and organizational development.

Harvard Business School graduate, post grad Executive Leadership Program, I am passionate reader on leadership, business and philosophy.

When not working or travelling, I get my adrenaline rush from racing, skiing, and mountaineering. These pursuits reinforce my belief in the importance of precision, and perseverance—values that resonate in both my professional and personal endeavours.

I am Carlos Santa Cruz, the CTO of Lynx and a Professor of Computer Science and Artificial Intelligence at the Universidad Autónoma de Madrid (UAM). I was involved in the development and design of the fraud and AML applications from the very beginning.

At Lynx, I lead the development of fraud detection and anti-money laundering tools. We use AI to help our customers identify and prevent fraudulent transactions.

I have a PhD in solid state physics, which gave me a strong foundation in mathematics, computer science, and statistics. I am passionate about AI because I believe it has the potential to make a real difference in the world.

I love being active in my free time. I am an amateur hiker and I love exploring new trails in the great outdoors. I always make time for my family and friends. We love spending time together, whether we are going on outings, just hanging out, or simply talking and laughing.

Business oriented CFO, with extensive experience working with international and multicultural teams. 20 years experience working for financial entities.

Over the last years I have had direct responsibilities in business and financial control, treasury, funding, accounting, cost control, taxation and operations. In addition to my direct responsibilities, I had a very active role in business development, implementation of business processes and IT systems. I promote integrity, proactivity and commitment spirit in the teams as well as the role of finance function in the coordination between different areas.

I have Business and Administration degree by Universidad Autónoma de Madrid and CFA charterholder.

With over 13 years of expertise in the cybersecurity sector, I bring a wealth of technical background in both offensive and defensive security practices. Before Lynx, I led the cybersecurity control and risk management model at Santander, driving robust protection strategies across all the Group. Prior to that, I led several projects of a cutting-edge cybersecurity lab at EY, specializing in offensive security and Red Teaming. My educational foundation includes a degree in IT Engineering and a master’s degree in Cybersecurity, underscoring my commitment to staying at the forefront of an ever-evolving field, as well as helping the cybersecurity sector as a speaker in cybersecurity-related trainings. Beyond the digital world, I find balance through my passions for playing the electric guitar and practicing kickboxing.

I’ve always been passionate about technology and gadgets. I studied computer engineering, and when I was in my last years of the career, a big card processor offered me a summer internship in its fraud department. I loved the job so much, that ever since I’ve been growing professionally in the developing of anti-fraud systems, working with Europe, LATAM and North America’s largest banks. Fraud in payment methods is a constantly evolving environment in which new technologies play an important role. Working in this market has offered me continuous challenges and learning sources for over 20 years.

Hi, I’m Juan Antonio Montesino Benitez. Before joining Lynx Tech as a Research & Development AML Manager, I spent some time at the IIC (Instituto de Ingeniería del Conocimiento – Knowledge Engineering Institute) as a Cloud Architect & Data Engineer in the Banking Analytics department and also as a Data Scientist at the Algorithmic Engineering department. My academic path includes a Degree in Mathematics by the University of Malaga and a master’s degree in data science and Big Data from the AFI School of finance, both Degrees with Extraordinary Prize from the promotion. Outside of work, I’m an avid traveler and enjoy Crossfit as a way to stay active.

Alyssa Iyer here! I’m the Head of Product for Anti-Money Laundering (“AML”) Solutions at Lynx. I have the incredible opportunity of working with an impressive group of data scientists and industry professionals to identify and implement cutting-edge technologies to detect financial crimes and optimize compliance operations.

Prior to Lynx, I was an Entrepreneur in Residence at Forgepoint Capital, a venture capital firm, where I was researching the latest regtech technologies, as well as helping portfolio companies apply their technologies to use cases in the compliance industry. Before joining Forgepoint, I was a Director in PwC’s financial crime unit, where I led large-scale AML engagements at global financial institutions. Throughout my career, I have worked closely with Tier 1 clients to effectively address process and operational pain points using tech-enabled solutions.

I received my Master of Arts degree in International Affairs from the George Washington Elliott School of International Affairs and a dual degree in International Affairs and Spanish from the University of Iowa. Outside of the office, I love hiking with my husband and son and keeping up to date on the latest foreign policy news.

Greg Hancell here! I’m the Head of Product for Fraud Prevention at Lynx. I help to bring your ideas to life. I work with a very talented data science and engineering team. Together we work hard to bring you cutting edge Fraud Prevention products.

Before joining Lynx I was at a startup, focused on server-side analytics. We grew the startup, and it was successfully acquired.

After which I focused on integrating and scaling up the two companies. The unison allowed us to bring innovative products to the market focused on intelligent authentication.

Later, I worked in Data Strategy and built a global fraud consultancy team. We focused on financial cybercrime, authentication, and fraud and successfully enabled multiple banks to become compliant to PSD2.

I enjoy the challenge of reducing fraud and operational costs with AI whilst delivering a unique user experience that end users enjoy.

Personally, I love being with my family, surrounded by nature, running, cycling, climbing and swimming.

Hola soy Natalia, Head of HR and Recruitment globally in Lynx. I love working with people, supporting them in their professional development and empowering their talents.

I’m responsible for the continuous development of Lynx´s HR strategy, culture, and process. My aim is to increase the greatest asset in Lynx, our brilliant people, where I focus on quality, care, and consideration.

Before joining Lynx, I contributed to Santander´s Group HR team, for more than 10 years, within its Technology and Operations division. Throughout these years I have been fortunate to work with talented leaders, managers, and employees across the company where I enabled them to deliver strong and consistent business results.

I never waver in my commitment to diversity and inclusion. I’m proud to lead a collaborative, innovative and customer-focused culture, and workforce.

With more than 15 years of experience in the banking sector, I have worked for the last 12 years with Santander Group as an in-house lawyer in the Corporate Legal Department, specifically with the Technology, Digital and Data team. Prior to Banco Santander I worked as a litigation and commercial lawyer in a Law Firm.

I have been passionate about law ever since I was a child. I always had the impression that this career gives you the opportunity to advise on and help push forward new and innovative ideas. I feel incredibly grateful to be a part of a team that is providing amazing solutions to the challenges and needs of the market and to society as a whole.

And here I am …! In this exciting challenge as the Head of Legal and the Secretary of the Board of Directors.

My educational background includes a degree In Law from the University of Granada, Jean Monnet Chair of European Constitutional Law from the University of Granada, University Master’s Degree in Legal Practice, PhD Programme in Criminal Law at the University of Granada, and Civil test for access to the Public Attorney’s Office.

In my free time I enjoy skiing, reading and traveling with my family.

I’m Lisa, Lynx’s Chief Marketing Officer, spearheading marketing strategy, brand development, and transformation. With over 25 years in B2B marketing, I specialize in aligning sales and marketing to propel company growth.

I’ve led marketing teams across diverse industries, driving brand strategy, go-to-market initiatives, and revenue enhancements. Most notably, I steered small startups to global prominence, culminating in acquisitions by industry giants, such as NuData Security, a small behavioral biometric company born in Canada, culminating in acquisition by Mastercard. I also played integral roles in transformative ventures like BehavioSec, subsequently acquired by LexisNexis Risk Solutions (LNRS).

My career reflects a dedication to innovative, impactful marketing strategies that resonate with diverse audiences. As a results-driven strategist, I specialize in generating demand, elevating brands, and harmonizing sales and marketing for exceptional outcomes.

On a personal note, I am based in Vancouver, BC, and I find solace in camping, cherishing quality time with my family, including our three dogs, and engaging in philanthropic pursuits.

I’m Commercial Director at Lynx. I love my job because I can get to know our customers (current and future) and help them develop their business and solve their problems. It also allows me to keep abreast of the latest technical innovations that appear on the market and that we incorporate into our products.

Before joining Lynx I worked in Business Development opening markets not only in Spain, but all around Latin America. I was very fortunate to be able to live in many different countries, getting to know other cultures and opening new markets for my Company. The knowledge I acquired in payment systems and fraud prevention allows me to know well the challenges my customers face and the peculiarities of their business.

I studied Physical Sciences and Business Administration, in Madrid. Also an AMP – Senior Management Executive Program at ESADE.

When I am not working, you can find me practicing ballet (I love it, not only for its beauty, but for the discipline and self-control it demands) and collaborating with NGOs and different universities and business schools.

Juan Pablo Jimenez is an Experienced sales Executive passionate about technology, Cybersecurity and delivering an amazing customer experience (CX). He is currently the Head of sales for Latin America at Lynxtech. Juan Pablo is an Electronic Engineer from the Escuela Colombiana de Ingenieria and holds a masters degree in Marketing and Sales from the Universidad de la Sabana. Juan Pablo brings more than 22 years of experience generating value for clients from different industries in Latin America (Banking, Insurance, Telco & Retail) in companies such as Mambu, IBM, Telmex and Oracle.

“Hi, I’m Dan McLoughlin, Head of Pre-Sales at Lynx. I’m involved in bringing the technical value of Lynx solutions to life for partners and customers and ensuring that our solutions remain best-of-breed. I’m passionate about preventing attacks on a holistic level, looking not only at the technology but the whole user experience and interaction. I believe that Fraud and Financial Crime can be defeated by not only using the best tools but implementing them in a way that works for an entire user estate.

I have over 24 years of experience in Cybersecurity and 15 plus years of working with financial institutions, helping them protect their customers. I have spoken worldwide on the subject and remain fully committed to keeping people safe and secure in their banking and payment journeys.

I have many interests outside of work, enjoying shared passions with family and friends like Golf, Music, Theatre, Travel and our large crazy dog. “

Managing Director for Brazil and Pre-Sales Director for LATAM and Brazil, I am also responsible for disseminating and evangelizing technical concepts, perspectives and trends in Risk & Fraud Management and Money Laundering Prevention.

I have a degree in Computer Science from the Pontifical Catholic University of Rio de Janeiro (PUC-RJ) and over 35 years’ experience in the Information Technology sector, having participated in the development of projects on various fronts, such as mainframes, low and medium platforms, Business Process Outsourcing (BPO) and network architecture in companies such as Chase Manhattan Bank, Banco da Bahia (BBM), EDS, EverSystems Vasco Data Security (OneSpan), among others.

My hobbies are family events: traveling with my family, movies, cooking and hosting friends at home and, very importantly, helping low-income families.

At the helm of Global Alliances at Lynx, I thrive on forging powerful synergies with consultancies, System Integrators, and technology partners, and regional resellers to catalyze our business growth.

My journey includes spearheading Global Partnerships at RSA/Outseer, where I led the channel and alliance team across diverse regions – EMEA, APJ, and the Americas. My knack for high-impact collaborations is evidenced by successful alliances with industry giants like LexisNexis Risk Solutions UK, ThoughtMachine, UBER & Lyft. My expertise further extends to leadership tenures in sales and partnership with LexisNexis Risk Solutions, Equifax, and Appriss Insights, culminating in a strategic acquisition by Equifax valued at $1.8 Billion.

Educationally, I earned an MBA with honors from Emory’s Goizueta Business School and a B.A. in Journalism/Public Relations from the University of Memphis, where I also excelled as a collegiate tennis player. As the former President of the Board of Directors for the Executive Women of Goizueta and a proactive Emory alumna, my roots in leadership run deep.

“I’m Aj, Director of Global Revenue Operations here at Lynx. Having formerly trained as a Chartered Accountant – working in practice for several years at both Deloitte and Grant Thornton LLP – I have dedicated the last decade of my career to the Cybersecurity industry. Prior to joining Lynx I spent 8 years as part of the senior management team responsible for growing global AI Cybersecurity leader Darktrace plc from Series B through to its successful listing on the London Stock Exchange in 2021.

I hold a first-class degree in History from Durham University and outside of work I spend my time enjoying precious moments with my young family and indulging in my passions for fitness and motorsport.”

OUR PURPOSE

May the Lynx

be with you

Protecting individuals, companies, and financial

institutions from fraudulent activities.

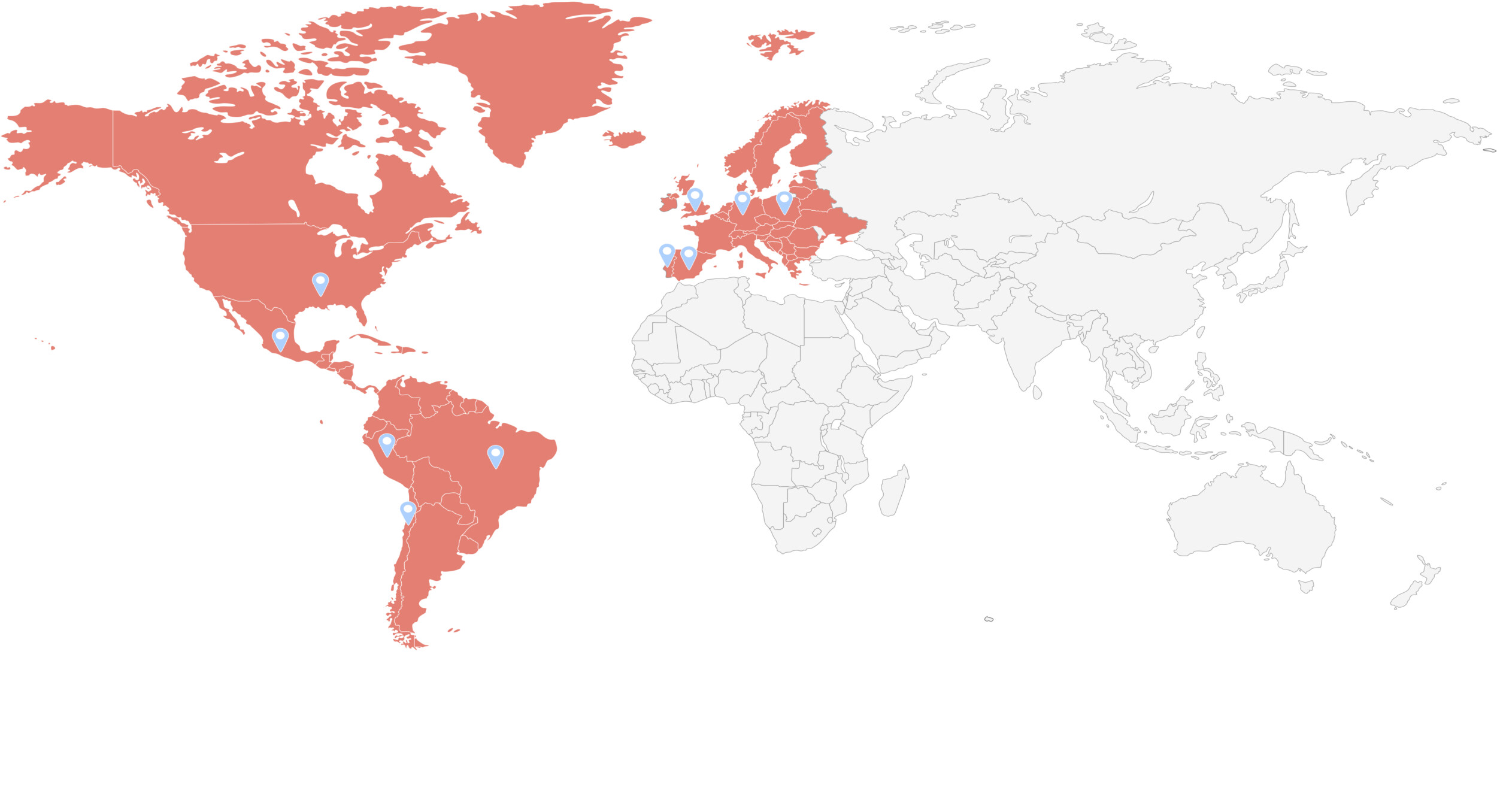

Global Impact

Lynx is trusted by multinational companies around the world whose customers span the globe.

Lynx illuminates and protects the world from fraud and financial crime.

Our capability to protect is second to none.

Global Presence

Lynx is proud to be partnering with companies all around the world. Lynx is used in the United States of America, Spain, Brazil, Peru, Chile, United Kingdom and Germany.