M...

AI Fraud prevention solutions for a Connected World. Stop fraud before it impacts your bottom line. Our multi-channel, AI-driven solution through machine learning models continuously adapts to evolving threats, protecting your organization and customers in real time, providing detection and prevention against fraud.

%

Global transactions secured annually.

%

Transactions processed in ❮50 ms*.

User Protection

%

Users protected globally.

%

Annual savings realized by clients.

%

Add a new channel for rapid deployment across all systems.

%

Value Detection Rate (VDR) minimizes financial losses.

Unlock Trust in Every Transaction with Lynx Fraud Prevention. Our AI-powered solutions adapt in real-time to predict, detect, and prevent fraud, ensuring robust security for your organization. At Lynx, we believe every transaction is an opportunity to build trust, reinforcing our commitment to secure financial interactions.

In this exclusive video, Banco de Crédito (BCP) shares their journey in combating fraud using Lynx’s advanced AI-driven solution. Discover how they’re setting new standards in fraud prevention, enhancing customer experience, and achieving a remarkable 30% reduction in fraud incidents.

This designation underscores our commitment to delivering cutting-edge, adaptive AI solutions that help financial institutions (FIs) combat the rising tide of sophisticated financial crime. Read More

New Analyst Recognition

Protecting Against Every Fraud Threat.

Lynx Fraud Prevention is tailored to address emerging fraud threats at enterprise scale for issuing banks, corporate and investment firms, payment service providers (PSPs), and acquirers. Our solution offers comprehensive fraud detection across all channels—including Card Present, Card Not Present, digital banking, mobile banking, telephone banking, and emerging technologies.

Challenge: Account takeover attempts from credential stuffing, brute-force attacks, and sophisticated phishing compromise customer accounts and your institution’s reputation.

Solution: Lynx’s advanced detection system identifies suspicious login attempts and anomalies, minimizing fraud losses and enhancing customer trust while reducing recovery costs and strengthening loyalty.

Solution: Lynx Flex dynamically adapts to new channels and data, analyzing transaction patterns and real-time risk scoring to identify anomalies. This enables comprehensive cross-channel fraud detection with minimal false positives, reducing losses and protecting genuine transactions.

Solution: Lynx generates behavioral insights for customers and beneficiaries, identifying suspicious activities and providing proactive protection against social engineering attacks, thereby reducing losses and safeguarding your customers.

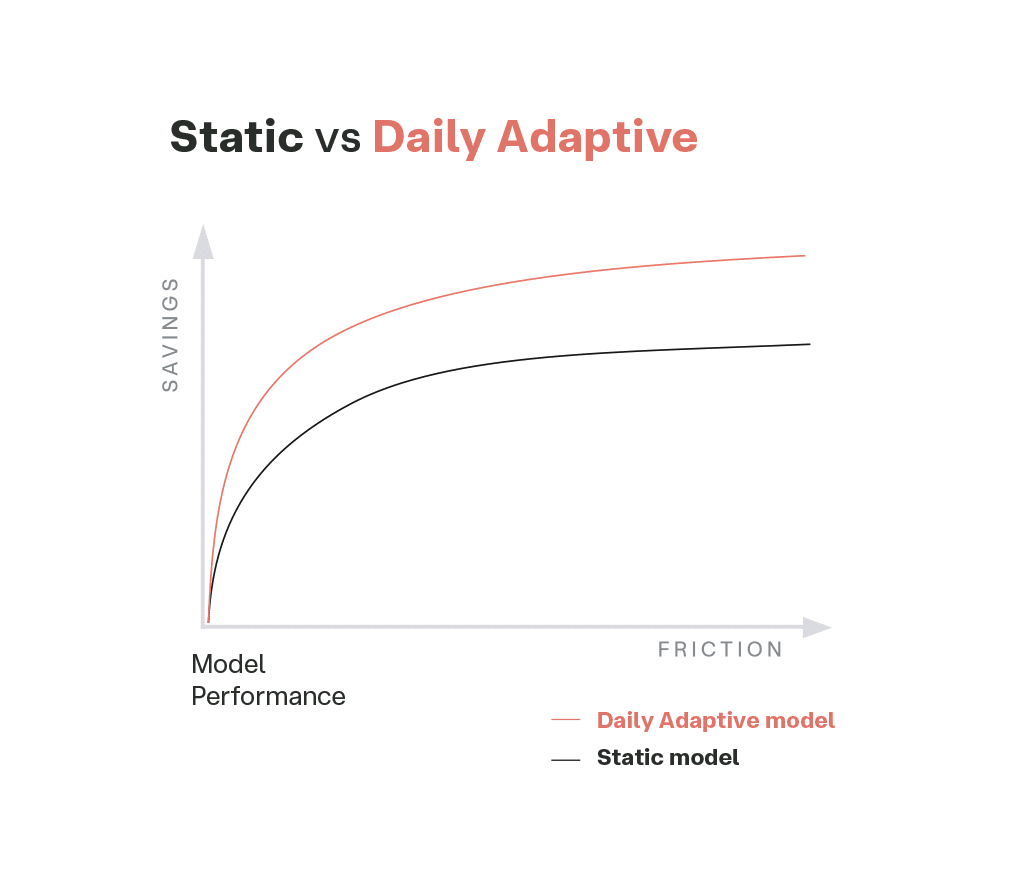

Solution: Lynx’s Daily Adaptive Models (DAMs) leverage supervised learning and daily updates to adapt to changing customer behaviors, payment technologies, and fraud patterns. Our proprietary machine learning models are built bespoke to your organization’s unique environment, detecting and neutralizing fraud in real time while driving savings, lowering friction, and improving customer trust.

Solution: Lynx offers a unified 360-degree view of transactions, channels, and users. Our no-code user interface seamlessly configures API and intelligence feeds, propagating new data fields throughout model training, rules, and reports. This empowers fraud analysts to make faster, informed decisions, enhancing the ability to combat fraud effectively.

Solution: Our solution meets SCA requirements through device fingerprinting, rich onboarding data, and risk-based scoring while ensuring transparency and explainability. We help you implement strong authentication methods to comply with evolving regulations and reduce fraud risk.

Lynx Fraud Prevention Fact Sheet

Financial institutions are increasingly challenged by the complexity of evolving criminal tactics, payment technologies, and user behaviors. The rise of real-time payments, combined with sophisticated fraud schemes, necessitates a dynamic solution that adapts in real time to effectively counteract these threats. Legacy systems often prove inadequate, resulting in a surge of fraud and unnecessary friction for legitimate transactions.

$3.1T

Illicit funds that flowed through the global financial system in 2023

Nasdaq Verafin 2024 Global Financial Crime Report | Nasdaq

$485.6B

Global fraud losses in 2023

Nasdaq Verafin 2024 Global Financial Crime Report | Nasdaq

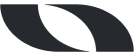

Lynx Fraud Prevention employs advanced machine learning models to assess the probability of fraudulent transactions. This system rapidly sends a recommended approve or deny decisions in milliseconds, ensuring swift and accurate transaction processing.

Illustration: Transactions flows

Our DAMs are designed to detect more fraud while minimizing false positives. This results in significant savings and reduced friction for your organization, enhancing overall operational efficiency. Our models adapt continuously to combat evolving attack strategies, boosting fraud detection efficiency. Change is constant—whether from shifts in user behavior, new financial products, or emerging threats.

As you move towards the daily adaptive model curve, you reduce friction and stop more fraud.

The process includes a straightforward transaction flow:

Explore How Lynx’s Advanced Daily Adaptive Models are

Transforming Financial Crime Prevention

Lynx’s solution is custom-built to tackle emerging fraud threats at enterprise scale for issuing banks, corporate and investment firms, and acquirers. We offer comprehensive fraud detection across key channels, including Card Present and Card Not Present payments, digital banking, mobile banking, telephone banking, and cutting-edge technologies like digital wallets.

Lynx deploys advanced Daily Adaptive Models (DAMs)—self-learning AI—to evaluate transactions and interactions for fraud in real time. Unlike static models, our DAMs continuously learn and adapt to new threats, ensuring exceptional accuracy while minimizing false positives. This proactive strategy empowers us to prevent fraud before it affects your institution.

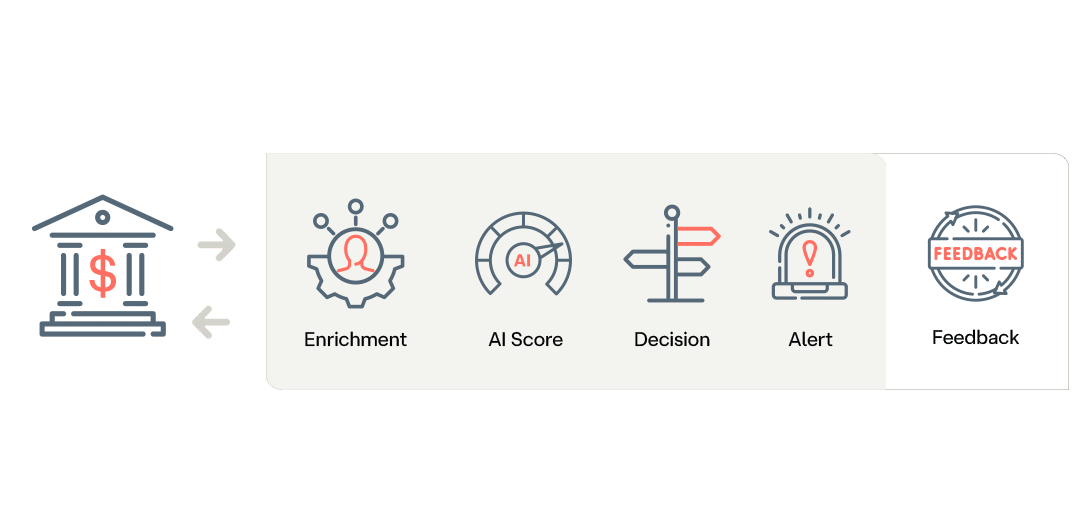

Easily integrate Lynx into your existing systems. We accept transaction and interaction data from any device or payment channel—online, mobile, card present, and card not present. Our proprietary in-memory databases enrich this data with contextual insights about historical user behavior, location, and related entities, significantly improving model accuracy and decision-making.

Our sophisticated machine learning algorithms generate precise fraud risk scores for each transaction. Lynx’s decision engine leverages these scores alongside your institution’s risk tolerance to suggest an “approve” or “deny” decision in under 50 milliseconds* for 99.99% of transactions. High-risk transactions are promptly halted and flagged for further review.

Our process is ongoing. Fraud analysts examine flagged transactions, supplying valuable feedback that refines our DAMs. This closed-loop system guarantees that Lynx continually learns, adapts, and enhances its fraud detection capabilities.

*Known performance where connection is TCP/IP socket and the solution is on-premise

Explore how Lynx combines advanced AI with user-friendly interfaces to provide real-time fraud detection and prevention. Below, you’ll find screenshots of our Dashboard, Alerts, and Rules, illustrating the powerful capabilities of our platform.

Lynx is trusted by multinational organizations across the globe. We detect and prevent fraud and financial crime with unmatched speed, accuracy, and expertise.

Our proprietary supervised machine learning algorithms detect more fraud than traditional rules-based or unsupervised solutions, providing superior performance.

Utilize our advanced AI risk scoring or deploy Lynx Fraud Prevention as a comprehensive solution. We can layer our capabilities over existing systems or rip and replace, based on your needs.

Our innovative feature generation algorithms swiftly categorize incoming data and automatically create relevant features. During model training, features correlated with fraud are selected, effectively combating feature selection bias.

Our proprietary onboarding and account feeder data supplements the original transaction payload for enhanced detection.

Instantly assess transactions and behaviors for rapid decision-making. Lynx processes 99.99% of transactions in under 50 milliseconds on-premises via TCP/IP sockets and 100 milliseconds for SaaS deployments through RESTful APIs.

Lynx is compliant with PCI-DSS, ISO 27001, and SOC 2, ensuring top-tier data security. We also meet ISO 20022 and ISO 8583 standards, guaranteeing your transactions align with global messaging requirements.

Ingest data from any payment channel with Lynx Flex, propagating it throughout the solution—from models to rules, reports, and dashboards. Our adaptable dashboards enable just-in-time queries and responses.

Send the data you want with the click of a button. Our no-code configuration, flexible responses, and seamless automations ensure that anyone on your team can utilize Lynx Fraud Prevention- no data scientists required.

Gain a unified customer view through dashboards powered by Kibana and Elastic, facilitating real-time insights.

Integrate with AWS cloud services or deploy Lynx on-premises to meet your operational preferences.

Accurate fraud risk scores are paired with a dynamically configurable decision engine, all within an intuitive interface that supports flexible responses and workflow automation.

Lynx’s proprietary in-memory database outperforms the competition.

Quickly integrate Lynx with your existing systems and workflows. While other solutions may take months, Lynx can be integrated in just days.

Our Daily Adaptive Models tune themselves daily without the need for any uplift or data scientists.

*average performance for an on-premise deployment using TCP/IP socket

At Lynx, we prioritize security and compliance, ensuring that our solutions meet and exceed industry standards. Our adherence to PCI-DSS, ISO 27001, and SOC 2 frameworks guarantees that your data remains protected, aligned with best practices, and managed with the utmost integrity.

Recognition

Lynx is a recognised leader in the detection and prevention of fraud and financial crime.

Gartner, Market Guide for Fraud Detection in Banking Payments, 11 December 2024, Pete Redshaw

GARTNER is a trademark of Gartner, Inc. and/or its affiliates. Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s Research & Advisory organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Stop more fraud, reduce false positives, and significantly lower costs with Lynx.

Discover how much you could save! Partner with Lynx to eliminate fraud and protect your customers. Our fast Proof of Concept (POC)—with no personally identifiable information (PII) required—will reveal your potential fraud savings and false positive reductions.

Acesse nossos artigos, white papers e insights para entender como o Lynx capacita as instituições financeiras todos os dias.

Lynx is recognized in the Top 50 of Chartis’ “Retail Banking Analytics50” report

Beyond the Transaction: Why Fraud Vigilance Is Essential for Stability

Lynx, awarded at the PAY360 Awards as Best Initiative in Utilising Data or AI

Lynx Tech is recognized by Gartner® in its 2025 Market Guide for Anti-Money Laundering

What is Causing the Rapid Rise in Fraud?

IA vs Money Laundering

How Argentina’s Policy Impacts AML Controls

Lynx mentioned in a Gartner report