N...

Financial institutions (FIs) face an increasingly complex transaction and fraud environment with ever-changing risks and payment technologies. It has never been more critical or challenging to accurately detect and prevent fraudulent transactions in real time.

According to Gartner, “CIOs should use this Market Guide to understand the trends, challenges and technological developments in the continuing fight against fraudulent payments and money movements.” We believe, Lynx’s recognition as a Representative Vendor in the Gartner report demonstrates our ability to deliver outstanding results through advanced AI in the fight against fraud.

The scope of fraud and financial crime are staggering. According to the 2024 Nasdaq Global Financial Crime Report, in 2023, $3.1 trillion in illicit funds flowed through the global financial system and victims lost $485.6 billion to fraud.

Authorized push payment fraud (APPF) in particular looms large. Globally, APPF accounts for 75% of all digital banking fraud and APPF losses across the US, UK, and India are expected to reach $5.25 billion by 2026. In the UK alone, APPF resulted in £459.7 million in losses in 2023. The country’s recent APPF reimbursement regulation is intended to curb the issue and stimulate investments in fraud prevention and money mule detection to better protect consumers.

What is driving this massive amount of criminal activity? Real-time payment rails and instant transactions have introduced real-time risks. Organized crime groups are capitalizing on the opportunity to target FIs and their customers to commit crimes including fraud and money laundering.

Fraud prevention solutions now must adapt to constantly evolving criminal tactics, payment technologies, and user behaviors in order to avoid drift and performance degradation. Rules-based solutions and unsupervised machine learning aren’t up to the task. Unfortunately, many legacy solutions leverage these approaches and struggle to keep up, leaving FIs and their customers at risk.

A shift to more adaptive and flexible AI-driven fraud prevention helps FIs maintain high accuracy and low false positives, ultimately protecting more consumers and driving significant fraud savings.

For us, our inclusion in the Gartner Market Guide validates our dedication to continuously innovating with AI and closely partnering with our customers to build more effective detection capabilities.

At the core of our efforts are Daily Adaptive Models (DAMs), supervised machine learning (ML) models that retrain daily to help FIs prevent more fraud, better protect their customers, and drive increased fraud savings- all in real time. Unlike static models that retrain infrequently and degrade over time, and unsupervised ML models which generate high false positive rates, DAMs maintain high detection accuracy with low false positives even as fraudsters adapt their tactics, payment technologies evolve, and users change their payment behaviors.

In addition, Lynx’s proprietary Flex technology enables dynamic payloads which incorporate new data fields and introduces data extensibility, allowing FIs to configure API and intelligence feeds through a no-code user interface and propagate new data fields to models, rules, and reports.

Lynx’s comprehensive solutions give FIs a 360-degree view of risk across all channels, devices, and customers. In addition to Lynx Fraud Prevention which uses AI to predict, detect, and prevent financial fraud, FIs can utilize Lynx AML to detect sanctions evasion and streamline compliance operations. Our recently launched Lynx Mule Detection also enables FIs to detect and stop illicit incoming funds and money mule accounts. Together, these AI-powered solutions represent our vision to develop the leading Intelligent Risk Platform to detect and predict all financial crimes in real time.

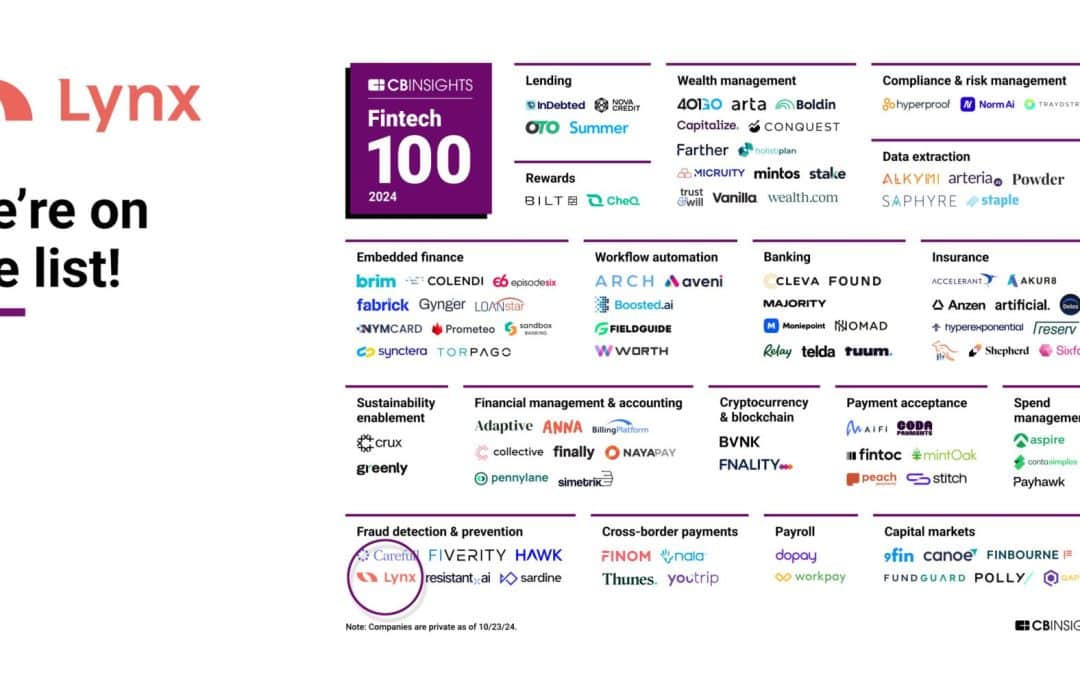

We believe, the recognition is just the latest reflection of our commitment to innovating financial crime detection with AI. In just the past several months, Lynx was recently recognized by Chartis as a category leader in the RiskTech Quadrant for Enterprise and Payment Fraud and our AML solution was acknowledged as a Best of Breed Solution in the Chartis 2024 RiskTech Quadrant for Name and Screening solutions. For us, these consecutive recognitions reinforce that our advanced AI models and no-code flexibility are revolutionizing the traditional approach to fraud prevention, enabling FIs to quickly and accurately handle complex fraud scenarios and high transaction volumes.

Lynx is setting the new standard for real-time fraud and financial crime detection. We are empowering FIs to strengthen their defenses and fight back against the cycle of crime with adaptive AI and flexible solutions.

Lynx saves FIs $1.6B in fraud costs globally with our market-leading Daily Adaptive Models*.

Ready to take the next step and transform your fraud detection capabilities? Reach out and schedule a Proof of Concept (POC) to see how much you can save.

*12 month trailing

Gartner, Market Guide for Fraud Detection in Banking Payments, 11 December 2024.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Let us assist you in the fight against fraud and financial crime.