Efficiency is critical in the fight against financial crime. Adapting to new threats in the shortest amount of time possible has never been more important. The latest Chartis Market Update and Vendor Landscape emphasizes the growing importance of low-code/no-code configuration options in enterprise and payment fraud solutions. This shift is democratizing fraud detection and prevention, making sophisticated, market-leading tools accessible to a broader audience. Our recent recognition as a category leader in Chartis’ RiskTech Quadrant® for both Enterprise and Payment Fraud solidifies what we’ve long known: no-code is not just a trend; it’s the future of fraud prevention.

The Importance of No-Code Solutions

No-code platforms are breaking down the traditional barriers that once limited advanced fraud detection capabilities to only the largest institutions with extensive IT resources. Now, companies across the financial spectrum can implement and adapt complex fraud prevention strategies quickly and efficiently, leveling the playing field and enhancing the industry’s overall resilience to financial crime.

The agility offered by no-code solutions is particularly crucial in today’s rapidly evolving fraud landscape. As criminals continually devise new schemes and tactics, financial institutions need the ability to respond swiftly. Reported cases of fraud are rising, and the amounts involved are getting larger. Last year, fraud losses in the UK rose to £2.3 billion, the second-largest annual fraud total in the past decade, representing a 104% increase compared to 2022 figures. Around the world, total losses were estimated at $485.6 billion, with payment fraud accounting for 80% of the total.

No-code platforms enable organizations to modify their fraud detection rules and models in real-time, without the need for extensive coding or IT intervention. Their ease of setup offers organizations unprecedented agility, improving the effectiveness of fraud prevention efforts while significantly reducing the window of vulnerability when new threats emerge. With the UK’s APPF regulation deadline approaching in October, no-code solutions offer banks the ability to seamlessly integrate AI-powered and machine-learning solutions to detect fraudulent transactions, potentially saving them hundreds of thousands of pounds in reimbursement costs.

The launch of Lynx’s Mule Account Detection solution earlier this year exemplifies this agility, offering real-time mule detection to combat the flow of illicit funds through the global financial system.

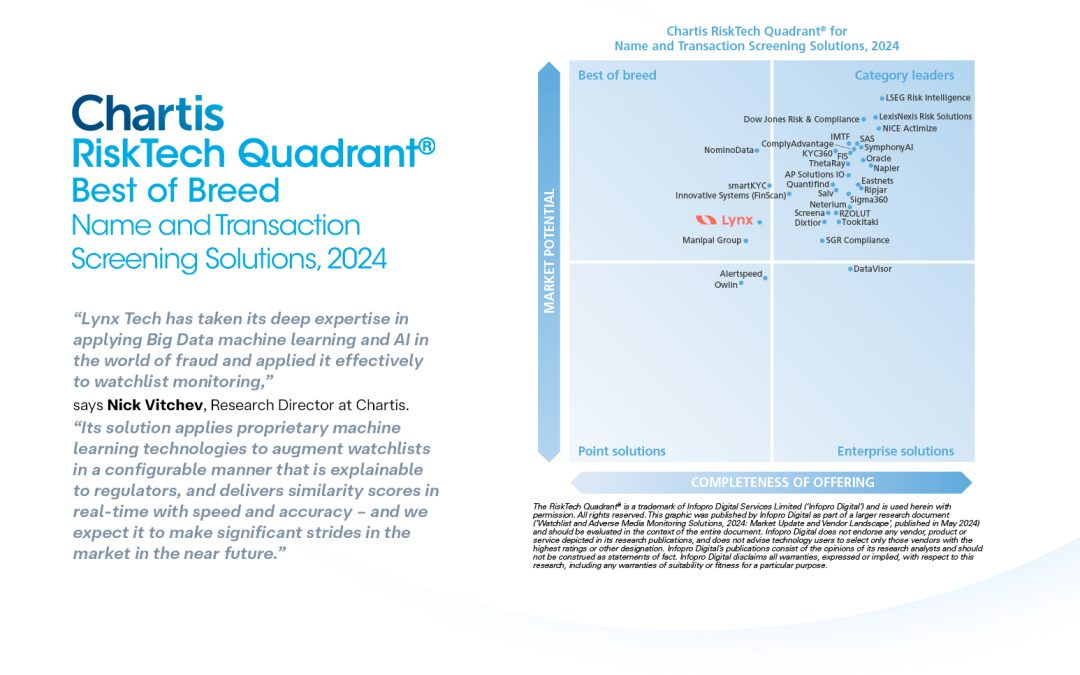

Industry Recognition for Lynx

Our commitment to no-code innovation in fraud prevention has been recognized by Chartis, a leading provider of research and analysis on the global market for risk technology. This is a true testament to the effectiveness of our approach and the strength of our solutions.

Lynx’s positioning as a category leader in both the Enterprise and Payment Fraud quadrants reflects our ability to deliver critical fraud management capabilities, backed by strong core technology and advanced modeling capabilities. Our AI-driven approach, coupled with no-code flexibility, enables us to handle complex fraud scenarios and high transaction volumes accurately and quickly across multiple channels.

Nick Vitchev, Research Director at Chartis, highlighted our capabilities, stating:

“Lynx’s category leader position in both quadrants reflects its ability to deliver in several areas that are critical to enterprise fraud management, backed by strong core technology and advanced modeling capabilities. Alongside strong behavioral modeling and the ability to customize for complex fraud scenarios and typologies, Lynx’s modeling strength in payment fraud enables it to handle high transaction volumes accurately and quickly across a number of payment rails.”