N...

Data privacy is paramount in today’s digital age, especially in combating financial crimes. This blog delves into a recently published report by the US Financial Crimes Enforcement Network (“FinCEN”), revealing the staggering extent of identity-related crimes in the US, totaling $212 billion in reported suspicious activities in 2021. As we unpack this report, I’ll discuss why robust data privacy measures are imperative for organizations to prevent and thwart financial crimes.

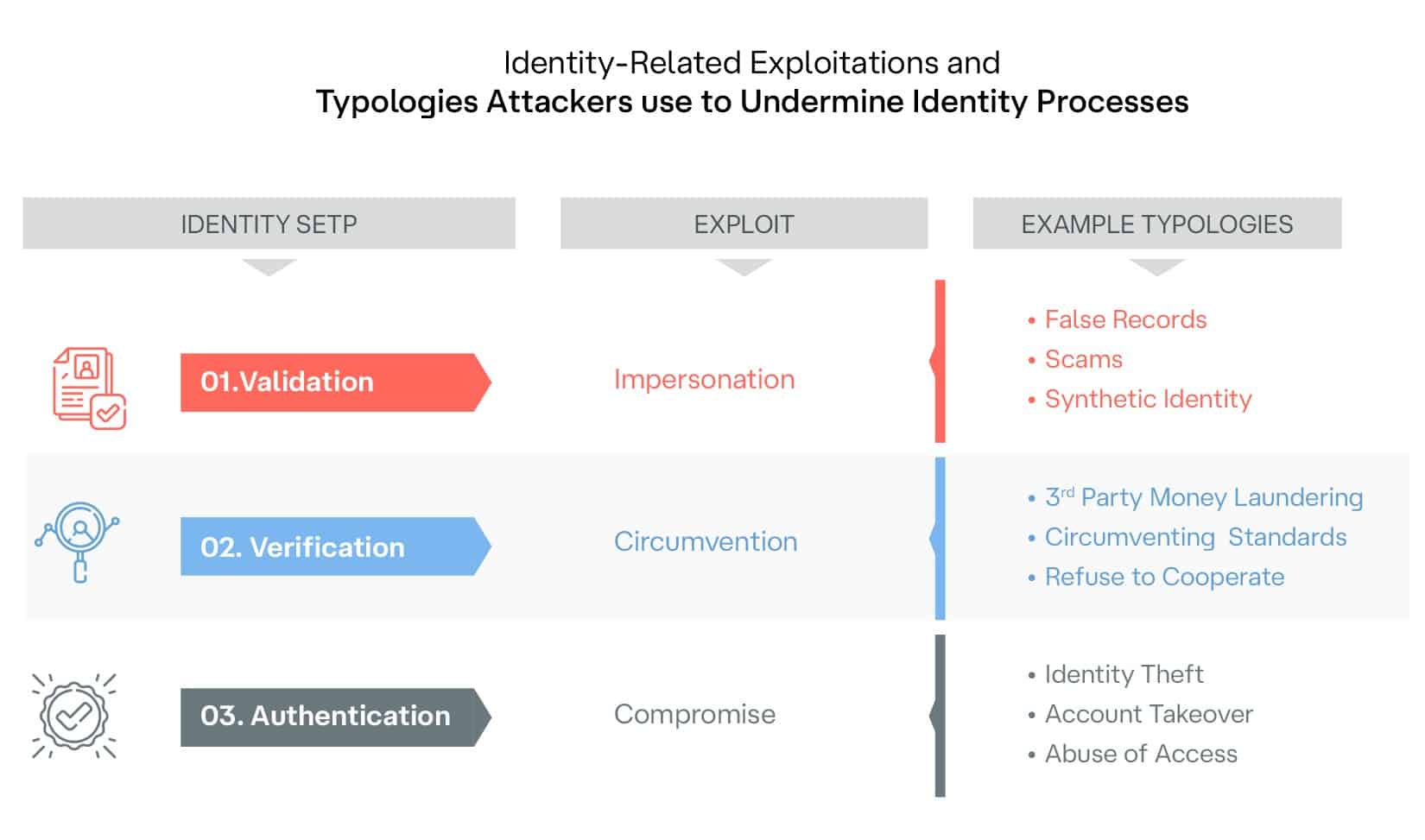

According to the FinCEN report, attackers exploit identity processes through impersonation, circumvention of verification processes, and using compromised credentials, showcasing the urgent need for preventative measures.

Data privacy plays a pivotal role in preventing identity theft, a crime that often stems from vulnerabilities in cybersecurity or social engineering tactics, emphasizing the need for preventative measures. Inadequate data security measures and weak cybersecurity controls create opportunities for cybercriminals to access sensitive personal information, leading to identity theft incidents. Additionally, social engineering scams manipulate individuals into willingly divulging their personal data. Once armed with this information, criminals can seamlessly open fraudulent accounts and engage in financial crimes. These vulnerabilities underscore the urgency for organizations to implement robust data privacy measures.

With stolen personally identifiable information (PII) in hand, criminals exploit weak Identity Verification and Validation (ID&V) policies to engage in financial crimes. Strong cybersecurity defenses are critical to prevent identity theft, but unfortunately, data breaches are common. Given this unfortunate reality, the FinCEN report underscores the essential role organizations need to play to identify the use of stolen identity data during onboarding processes to stop them in real time. KYC is the frontline for preventing these criminals from gaining access to the financial sector and continuing their criminal activities.

To give a real-life example, money mules will add the credit cards of individuals whose identity they have stolen to purchase goods; then they resell those goods on eBay. The buyers of those goods have no idea that they are enabling this criminal activity. Therefore, merchants should set up solid policies to protect themselves and their customers from facilitating these crimes. Strong reseller KYC requirements ensuring the name on the credit card is linked to the customer’s name can prevent fraudsters from using credit cards from a stolen identity.

This example highlights the importance of strong KYC policies to prevent unwitting customers from becoming money mules.

The FinCEN report sheds light on various typologies exploited by identity-related crimes, with fraud being the most reported, followed by false records, identity theft, and third-party money laundering.

With $149 billion in suspicious activity linked to fraud, organizations must deploy advanced fraud detection tools for real-time identification. If fraudulent transactions occur, this means the KYC process has broken down, criminals have gained access to the organization and can transact. But with real-time fraud detection, institutions can at least spot, stop, and report these criminals immediately once fraud is detected.

Organizations cannot stop there. Continuous learning from positive fraud cases is crucial to enhancing prevention efforts, meaning properly labeled data must be fed back into the models. This will help organizations continue to prevent these types of activities.

Additionally, advanced transaction monitoring capabilities can identify red flags associated with third-party money laundering in real time, enabling prompt reporting to law enforcement.

These insights emphasize the urgency for organizations to implement robust fraud detection tools and real-time transaction monitoring capabilities to identify and mitigate threats promptly.

This FinCEN report shows how criminals know no boundaries. Their methods attack cybersecurity and KYC defenses and have multiplying effects in fraud and AML. And with the rapid evolution of AI, these attacks will only become more sophisticated and more challenging to detect. This underscores the importance of joint intelligence in real time to detect these cross-cutting typologies. Criminals do not work in siloes; organizations cannot afford to either.

Figure 1: Reference Source: FinCEN Report

The FinCEN report serves as a stark reminder of the sophisticated tactics employed by criminals in exploiting identity-related processes. As organizations navigate the customer lifecycle, from onboarding to transactions, joint intelligence becomes paramount for spotting and stopping these crimes in real time. By prioritizing data privacy, implementing stringent KYC procedures, and leveraging advanced fraud and fincrime tools, organizations can fortify their defenses and contribute to a more resilient financial ecosystem.

Let us assist you in the fight against fraud and financial crime.