N...

The partnership will help ensure banks and other financial institutions across the UK and Europe have access to Lynx’s advanced, AI-powered solutions to combat fraud and financial crime.

Lynx originated from the University of Madrid twenty-five years ago, and enables leading financial institutions, including Santander, PagoNxt, BCP and Cielo, to evolve from reactive to proactive fraud prevention.

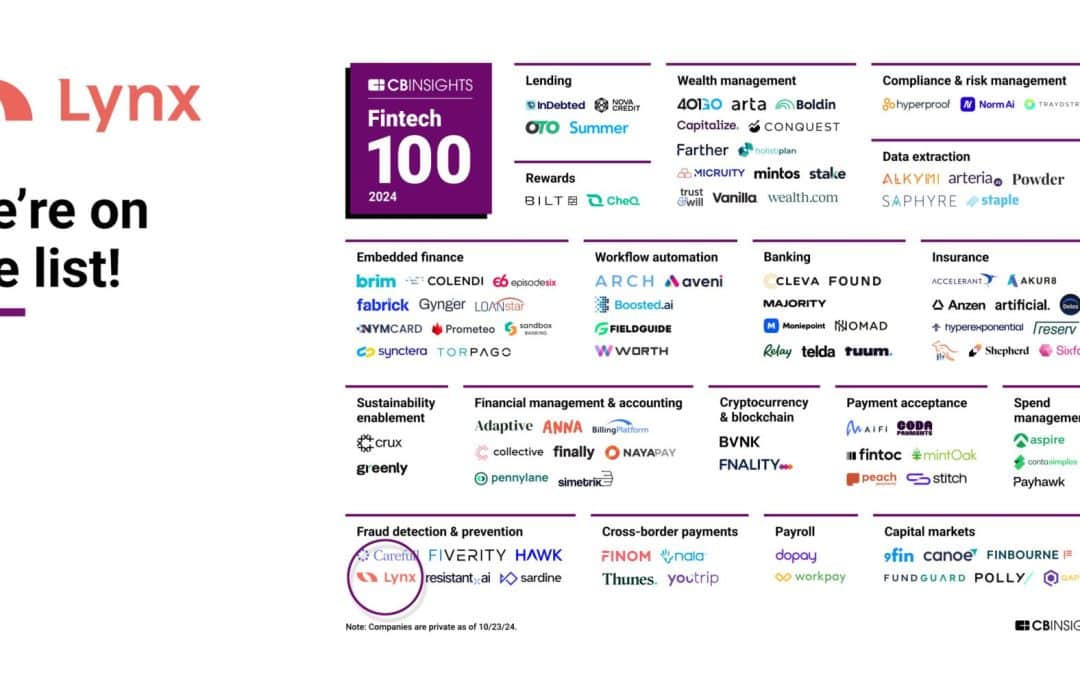

Lynx’s value proposition is AI-driven software which specialises in fraud detection and Anti-Money Laundering (AML). With its global presence, Lynx’s cutting-edge technology currently monitors 99.5% of all card transactions in Spain, 65% in Mexico, and 35% in Brazil.

Key features and benefits of Lynx’s solutions include:

“We are thrilled to partner with Lynx, a company that shares our commitment to innovation and excellence in the financial services industry,” said Sumant Kumar, CTO, Banking and Financial Markets | Head of Innovation, at NTT DATA UK&I. “With this new partnership, we will enhance fraud detection capabilities for banks worldwide, expanding our combined reach and ensuring safer transactions for all.”

“Our collaboration with NTT DATA marks a significant milestone for Lynx,”

said Lucy King, Director of Global Alliances, at Lynx.

“By coupling NTT DATA’s extensive industry experience with our cutting-edge solutions, we are poised to transform the landscape of fraud prevention across the financial services industry.”

Let us assist you in the fight against fraud and financial crime.