N...

Detect, Prevent, and Comply Using AI With Lynx’s Modular AML Solutions.

Integrate AI software into your compliance tech stack to reduce false positives, create risk-aligned operations, and achieve stronger regulatory compliance.

%

The false positive rate for enhanced accuracy.

Name variations analyzed using advanced NLP algorithms.

Transactions screened per second for quick processing.

Native data integration and seamless transformation.

Average response time for swift results.

Actionable KPIs & KRIs, tailored to your needs.

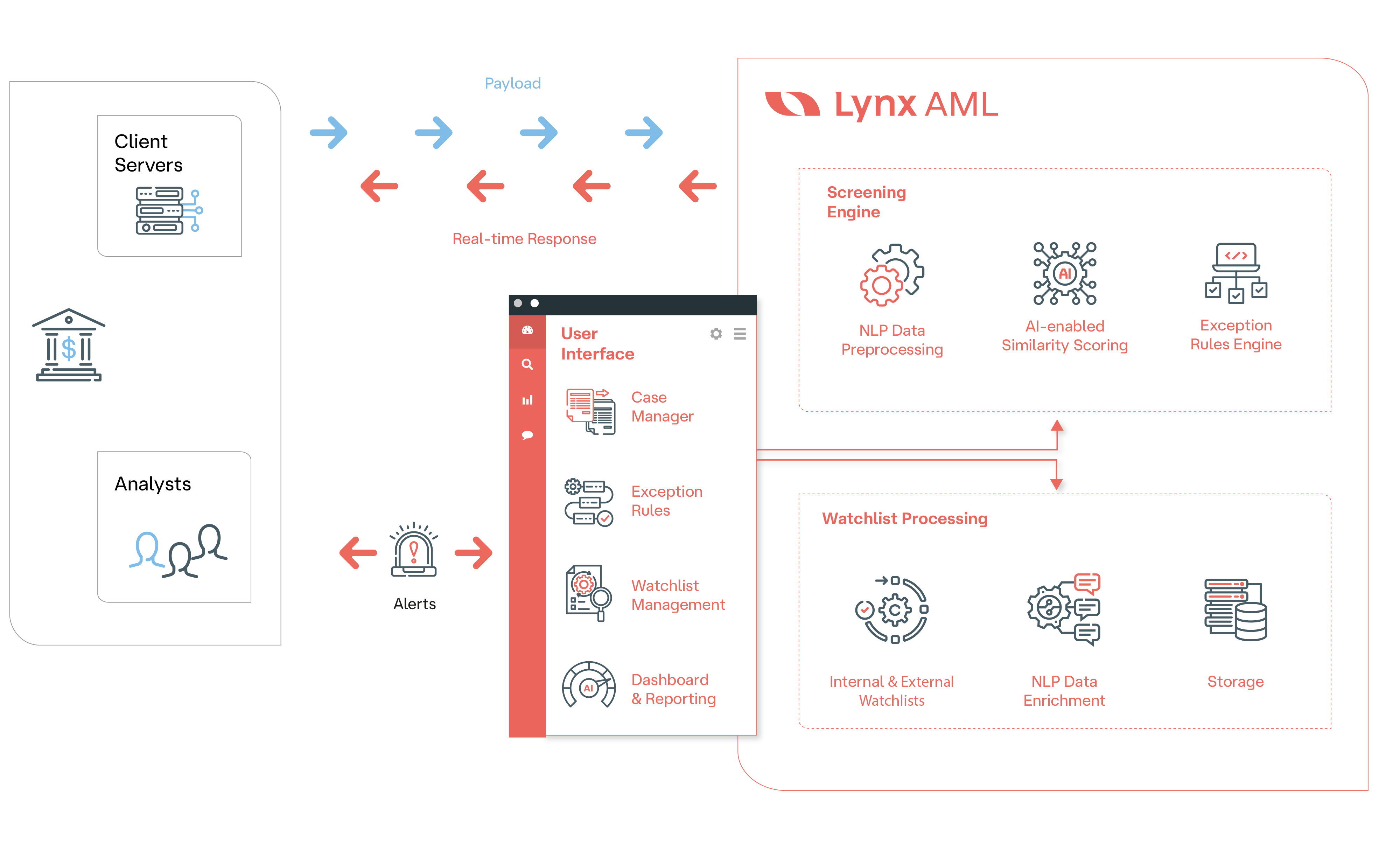

Lynx delivers smarter, more efficient approaches to AML screening, transaction monitoring, and watchlist management, tailored to your needs. Our AML modules seamlessly integrate with your existing tech stack and add immediate value.

With cutting-edge technology and a human-centered approach, we help your institution reduce compliance costs and automate low-risk, high-value activities so your team can focus on the most critical and high-risk alerts.

Transform your AML strategy today!

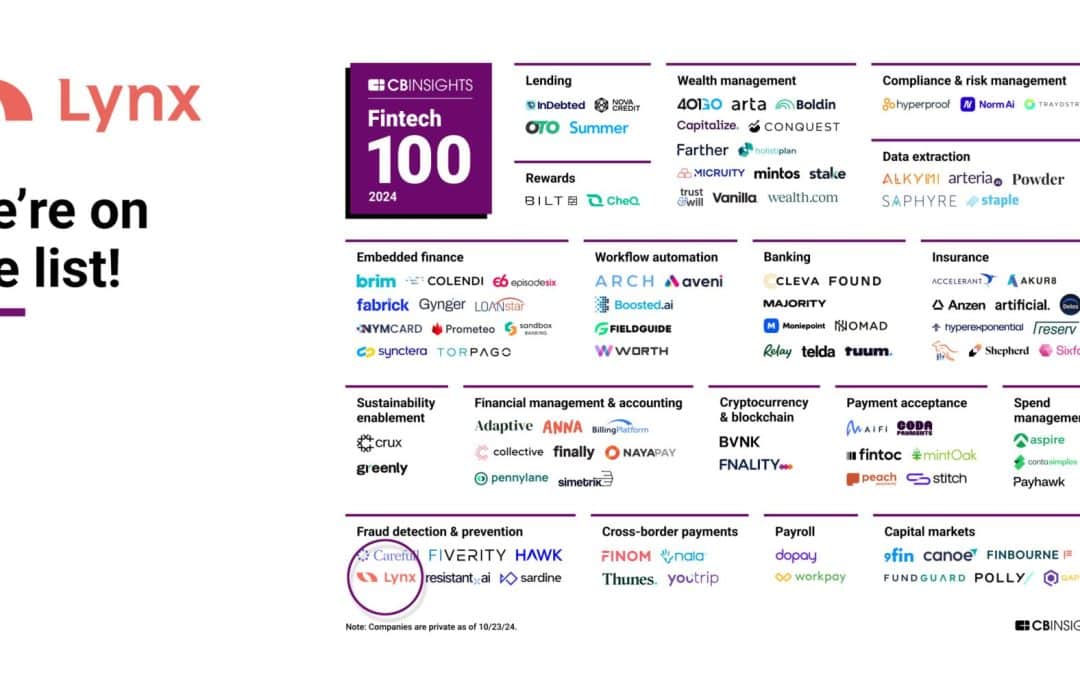

Lynx AML has been named Best of Breed in Name and Transaction Solutions by Chartis in 2024 and 2025. Our solution boasts industry-leading capability scores in Data Methodology and Speed, underscoring Lynx’s superior performance and accuracy in mitigating money laundering risks while enhancing compliance and combating financial crime.

To maintain strong compliance, reduce false positives and increase screening accuracy with Lynx’s audit-ready infrastructure.

Easily meet regulatory requirements with Lynx’s audit-ready infrastructure. Our transparent rule builders simplify compliance and provide peace of mind in your operations.

Lynx helps you get the most out of your AML stack by integrating AI with guardrails across your systems. There’s no need to rip and replace your current tech: our AML modules seamlessly layer on top of your stack and quickly add intelligence for immediate value. We help you develop a stronger risk-aligned name and payment screening, transaction monitoring, and watchlist management for greater compliance, all while maintaining clear explainability.

Or are you looking for a fresh start instead? Fully replace your legacy solution with Lynx’s comprehensive AML platform.

Identify risky entities at onboarding and throughout the customer lifecycle with Lynx Customer Screening’s real-time and batch screening.

Identify and block transactions involving prohibited entities with Lynx Payment Screening. Our comprehensive machine-learning models analyze millions of name variations to deliver the most accurate alerts.

Advanced nesting capabilities to effectively pinpoint risk typologies across customers, threats, and products without increasing false positives.

Generate a customized delta list that aligns with your policy and risk tolerance, eliminating the need for multiple lists from various providers. Achieve accurate reconciliations with a single comprehensive view of changes, updated daily.

Legacy AML solutions are rules-based and rigid, operating with fixed logic and inflexible watchlist management. They do not offer targeted rescreening and usually require manual analyst and case management processes. Tech debt causes slow integrations and time to value, with significant developer time required to customize solutions to FIs’ policies and processes. Adding to the challenge, analysts must switch between countless applications to view disparate data sources.

These slow-moving systems prevent FIs from quickly adapting to evolving risks and produce high false positives, operational strain and alert fatigue, analyst burnout, customer friction, and high operational costs.

Global spend by FIs on financial crime compliance tech in 2024.

Identify risky entities at onboarding and throughout the customer lifecycle. Lynx Customer Screening helps you address the full spectrum of watchlist, sanctions, politically exposed persons (PEP), and adverse media risks at scale with real-time and batch screening.

Screen any number of customers in real-time or with batch screening. Lynx Customer Screening helps you screen customers at scale, whether you need high-volume enterprise screening or targeted low-volume capabilities.

Tailor screening and watchlist sources to meet compliance requirements and match your risk appetite. Lynx Tailored Delta List makes it easy to define rescreening triggers, incorporate targeted watchlist changes, and achieve accurate reconciliations with a single comprehensive view.

Reduce alert processing times and drive consistency across case management with our unified user interface. Unlike legacy systems which leverage data sources across multiple applications and add time to investigations, Lynx consolidates all data points in one place- including alerts, watchlist hits, and customer details.

Detect watchlist, PEP, and adverse media risks with precision. Lynx’s name screening engine uses advanced Natural Language Processing (NLP) to enrich and analyze millions of name variations in just milliseconds, widening your search before narrowing it to deliver a highly accurate AI similarity score.

Identify trending risk typologies, monitor investigator performance, and effectively manage your AML operations. Our custom real-time reporting dashboards deliver real-time KPIs and KRIs. They are ready to use out of the box and can also be customized to deliver the exact data and views your stakeholders need to make informed decisions.

Detect sanctions risks with speed and precision. Lynx’s name screening engine enriches and analyzes millions of name variations in just milliseconds, widening your search before narrowing it to deliver a highly accurate similarity score.

Align alert rules to your policies to optimize oversight and minimize false positives. Specify screening techniques, match rates, and which watchlists to screen with our highly configurable no-code rule builder.

Create exception rules to ensure accurate alerts. Manually add entities to the exception list or add recommended entities.

Continuously tune custom rules without impacting production. Our sandbox simulation capability helps you predict how rules and thresholds will impact alert volumes.

Our case management system automates manual tasks like alert classification and assignment. We enable fully configurable, flexible workflows to streamline investigations and help your analysts prioritize high-risk and high-impact alerts- no developers required.

Identify trending risk typologies, monitor investigator performance, and effectively manage your AML operations. Our custom real-time reporting dashboards deliver real-time KPIs and KRIs and are ready to use out of the box. They can also be customized to deliver the exact data and views your stakeholders need to make informed decisions.

Enhance your existing tech stack with advanced AML Transaction Monitoring rules through our AML TM API module.

Lynx Transaction Monitoring is an API module with configurable rule building and sandbox testing. It fully integrates with your existing case management solution, allowing you to manage alerts and cases seamlessly outside of Lynx.

With Lynx AML TM, there’s no need to rip and replace your existing technology. Simply add the module to your current AML stack and layer Lynx’s transaction monitoring intelligence for immediate improvements.

Our systems are designed for efficiency. We launch AML Transaction Monitoring servers as needed instead of continuously calculating variables, keeping your costs low while maintaining high performance.

AML TM data integration: Long, costly, and painful! Lynx Layouts streamlines this, enabling rapid deployment and ongoing customization. Ingest data from any vertical or business line at any time; configure rules and thresholds yourself without the need for software development or professional services.

Continuously tune custom rules without impacting production. Our sandbox simulation capability helps you predict how rules and thresholds will impact alert volumes.

Analyze transactions at scale, whether you need high-volume enterprise monitoring or targeted low-volume capabilities.

Incorporate unsupervised machine learning models in a configurable and transparent manner to identify trends and red flags. We work with you to identify the right level of ML and AI to apply based on your risk appetite.

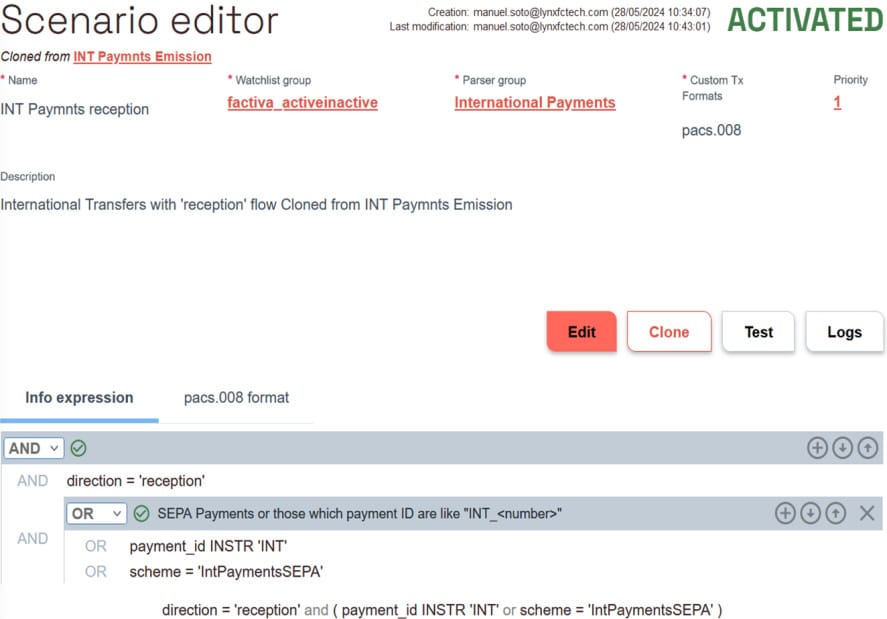

Lynx´s TM AML rule builder gives you the ability to create complex rules that legacy solutions can’t, all in a no-code engine.

Nested rules facilitate targeted detection and reduce false positives by layering multiple criteria in a hierarchy. E.g., using Lynx’s rule builder, you can create rules targeting smurfing by flagging multiple deposits under $10,000 within 24 hours if the same client transfers to a high-risk jurisdiction. Most legacy solutions can flag these deposits but cannot restrict rules to a specific time period or incorporate another typology, like a high-risk jurisdiction

Set alert thresholds based on the risk of the client, type of product, country, business type, or any other risk category.

Eliminate blanket threshold rules that increase false positives. Our rule builder allows you to write rules that pinpoint specific risks including particular typologies and behaviors for targeted high-risk entity types, customers, geographies, or entity lists.

Unlike legacy tools requiring lengthy warm-up periods, deploy new rules immediately. Our big data algorithm assesses unusual patterns from day one —no six-month waits for implementation.

Generate a customized delta list that aligns with your policy and risk tolerance with Lynx Tailored Delta List. Achieve accurate reconciliations with a single comprehensive view of changes, updated daily.

In today’s ever-evolving geopolitical environment, watchlist changes are constant. Unfortunately, so are false positives and unnecessary rescreening for most Financial Institutions (FIs).

FIs need to conduct ongoing customer screening to determine if watchlist and customer profile changes indicate increased customer risk. To facilitate this, watchlist providers offer delta file services which include day-to-day watchlist entry changes.

Most of these delta files aren’t tailored to your specific risk policies. They simply track every watchlist change.

This generates a large number of alerts based on irrelevant changes. Any and all watchlist and customer profile changes may trigger alerts.

The burden falls on your team to manually filter out unnecessary updates and false positives in addition to reconciling watchlist files. Keeping up with changing watchlists becomes a full-time job.

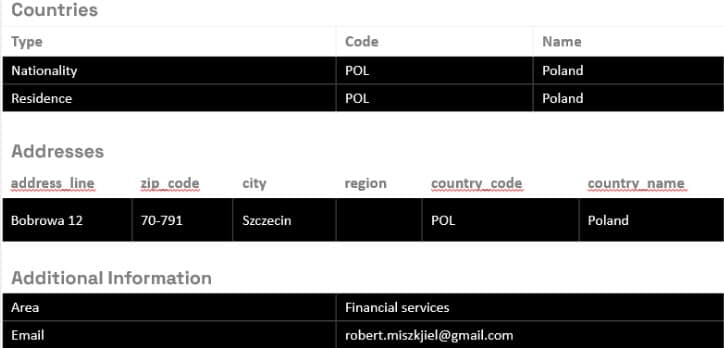

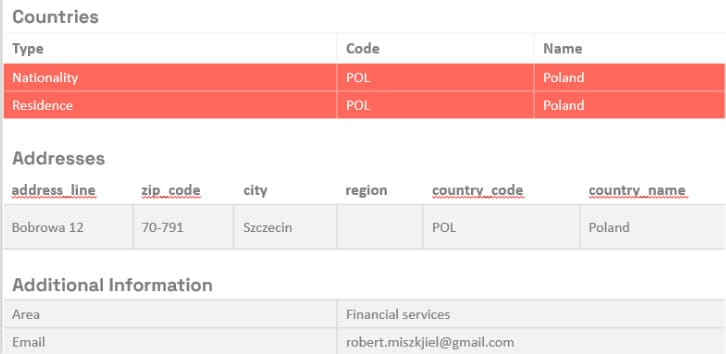

Fields in black will trigger alerts when updated

Fields in coral will trigger alerts when changed. Fields in grey will not trigger alerts when changed

Lynx’s Tailored Delta List solution enables you to outline the changes that trigger rescreening.

Customize which watchlist and customer profile updates trigger rescreening, from new watchlist entries to updated addresses and more. Our solution creates a tailored list of entities that have new pieces of information based on the inputs from your policy.

Our configurable rule editor allows you to specify the attributes that prompt screening at onboarding and rescreening. Create rules and filters specific to policies, countries, channels, customer profiles, data types, products, and more.

Automatically reconcile watchlist files over multiple days for the absolute delta of what has changed between specific periods of time. Lynx shows you absolute changes between lists without the need for manual reconciliation.

Stay in compliance with changing lists and evolving data sets throughout the customer lifecycle:

Solution: Lynx’s real-time architecture empowers you to effectively manage the risks associated with real-time payments:

Challenge: Global watchlists and sanctions lists frequently update, demanding constant monitoring and manual reconciliation to understand changes and maintain compliance.

Solution: Lynx enables configurable watchlist management:

Challenge: Given ever-changing watchlists, regional regulatory requirements, and unique risk appetites, FIs need to implement a risk-based AML approach that matches their specific needs and risk profile.

Solution: Lynx empowers you to implement a risk-based AML program:

Challenge: FIs need to comply with stringent AML and CTF regulations mandated by the local regulator while managing high customer onboarding and transaction volumes. Legacy AML technologies using only rules-based or fuzzy matching methodologies are rigid and rely on fixed logic. They generate high false positives and create operational strain and alert fatigue.

Solution: Lynx leverages AI to optimize name matching:

Challenge: Leveraging the power of AI-enhanced name matching is crucial for accurate and compliant AML operations. However, many FIs are hesitant to adopt AI-based solutions due to “black box” concerns about explainability and non-compliance risks including large fines and reputational damage.

Solution: Lynx applies AI to enhance name matching while prioritizing transparency and explainability for compliance:

Challenge: FIs need the ability to pull and present targeted data for diverse groups of stakeholders- from auditors and regulators to the C-suite and Board- without unnecessary details and data fields. In addition, they require insights into AML data to understand staff performance and risk trends. Legacy systems tend to fall short, offering inflexible reporting that is rarely real time.

Solution: Lynx provides real-time KPIs to empower informed decision-making:

Challenge: Maintaining a clear audit trail is essential for compliance with regulatory requirements. Gone are the days of black box hard-coding: regulators expect you to understand and own what’s being screened and how it’s done.

Solution: Lynx provides fully auditable AML solutions:

Screening customers and payments for money laundering risks is a complex process. From watchlist management and rule building to alert generation, case management, investigation, and reporting, FIs need to prevent money laundering and maintain compliance without becoming inundated with operational inefficiencies.

One of the core problems in screening relates to common names and name variations. FIs must cover all potential name variations without driving up false positives, often employing a mix of AML technologies with varying levels of maturity which leads to inconsistent screening.

Lynx overcomes this challenge by combining advanced machine learning, natural language processing (NLP), and artificial intelligence (AI) to comprehensively enrich watchlists and pinpoint risk.

We apply advanced Natural Language Processing (NLP) and data analysis methodologies to cleanse, standardize and enrich watchlist names.

This enrichment ensures comprehensive name variation coverage- and peace of mind for you and regulators.

Phonetic variations like homophones: Different spellings of a name that produce the same pronunciation Sara vs. Sarah

Cultural variations: Two names with different spellings that refer to the same name Muhammad vs. Mohamad

Alphabet variations: the same name written in different alphabets

Kishida vs. 岸田

Word variations: words or phrases that have more than one complete word different from one another

John Doe Construction Company Limited vs. John Doe Construction

Complex patterns: Such as Jeal-Paul, De la Cruz

Mistakes or intentional misspellings: John Doe vs. J%hn D&e

Lynx then narrows the search by applying AI. Our proprietary AI model adapts to the specific characteristics of each name and generates an optimized similarity score in just milliseconds.

Lynx’s AI model is trained on diverse datasets, enabling it to identify subtle patterns, variations, and cultural nuances. We additionally leverage neural networks to dynamically apply the optimal combination of NLP algorithms, moving beyond the legacy single-algorithm approach.

This unique approach not only ensures the most accurate alerts but also significantly minimizes false positives, freeing analysts from unnecessary investigations and enabling them to focus on addressing high-risk activities.

What is Causing the Rapid Rise in Fraud?

IA vs Money Laundering

Lynx mentioned in a Gartner report

Impulsando a PSPs con Estrategias Integrales para AML

Enhancing Compliance and Customer Experience for PSPs

From Cost Center to Revenue Generator

Daily Adaptive Model

Navigating Sanctions in a Faster Payments World: 4 Key AML Insights

Reach out to our expert team to learn how we can help.