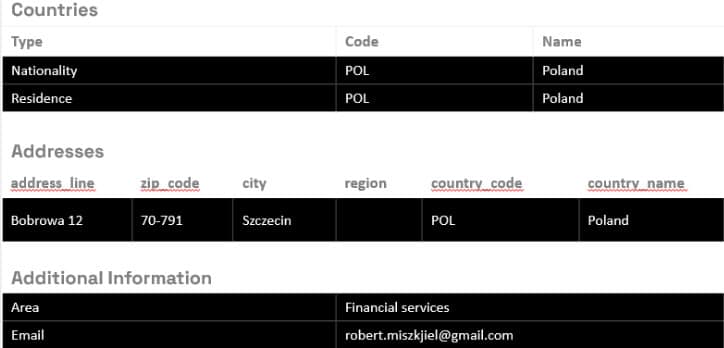

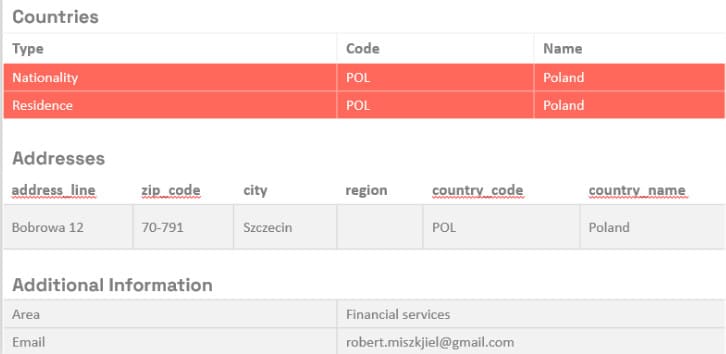

In today’s ever-evolving geopolitical environment, watchlist changes are constant. Unfortunately, so are false positives and unnecessary rescreening for most Financial Institutions (FIs).

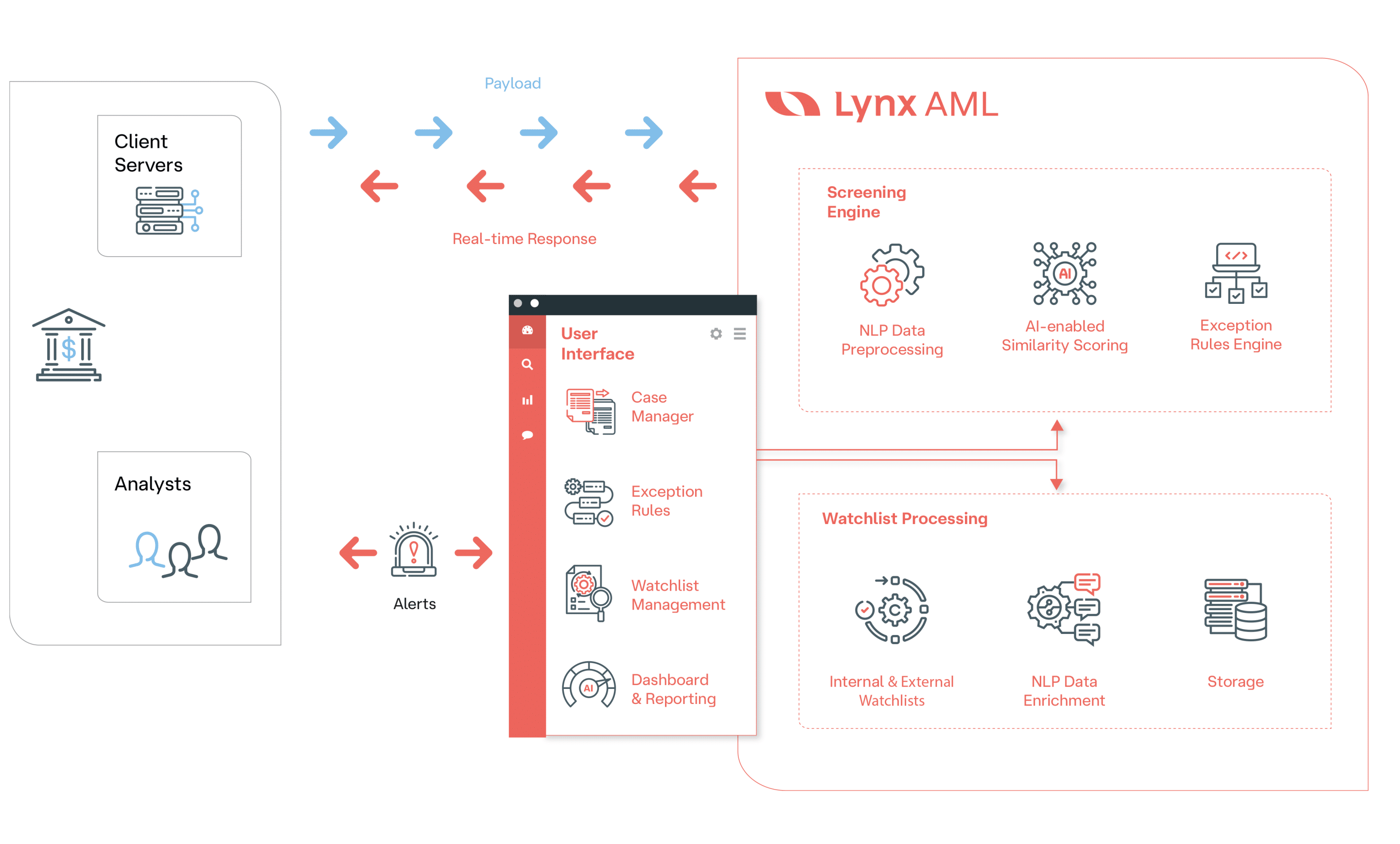

FIs need to conduct ongoing customer screening to determine if watchlist and customer profile changes indicate increased customer risk. To facilitate this, watchlist providers offer delta file services which include day-to-day watchlist entry changes.

Most of these delta files aren’t tailored to your specific risk policies. They simply track every watchlist change.

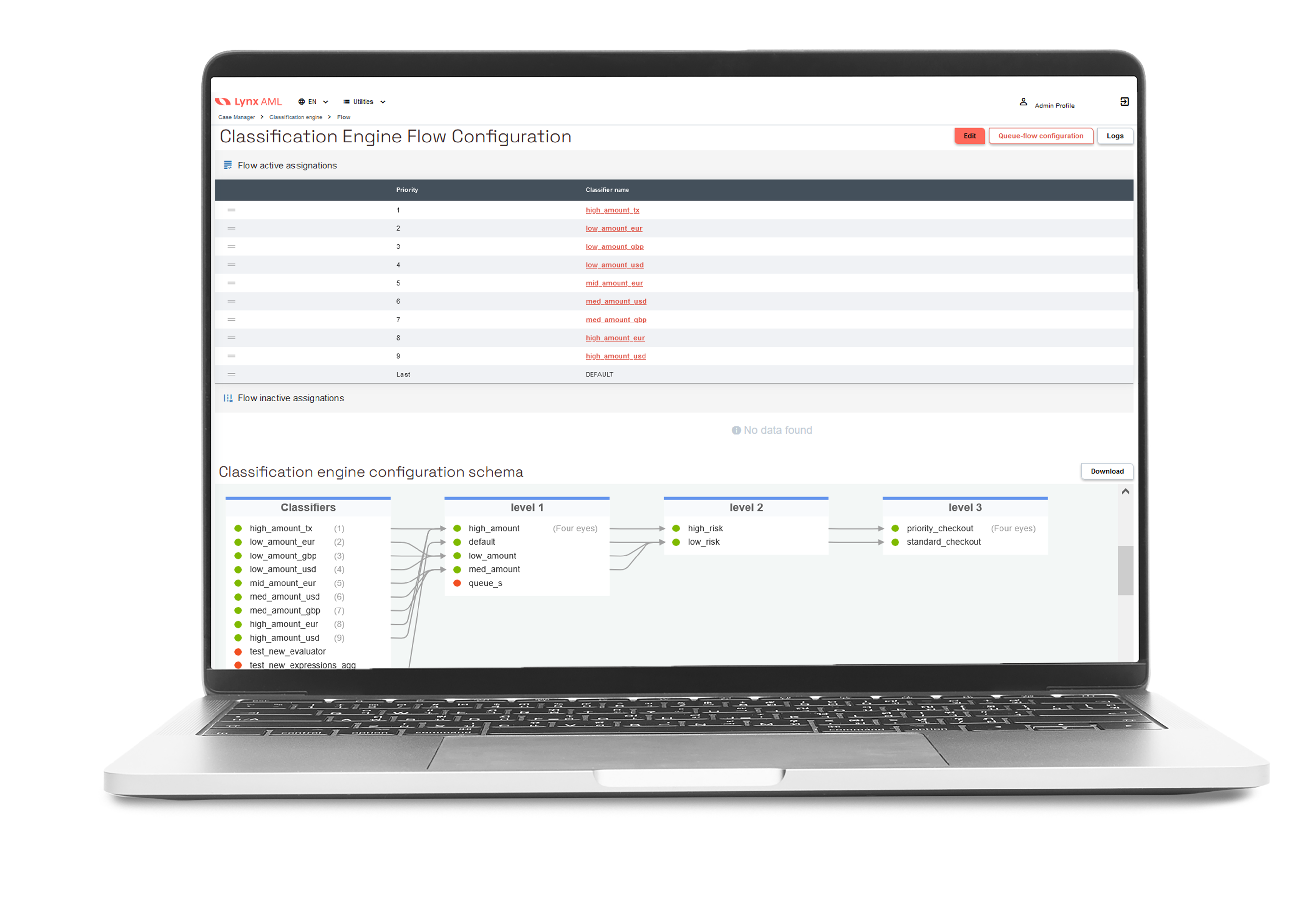

This generates a large number of alerts based on irrelevant changes. Any and all watchlist and customer profile changes may trigger alerts.

The burden falls on your team to manually filter out unnecessary updates and false positives in addition to reconciling watchlist files. Keeping up with changing watchlists becomes a full-time job.