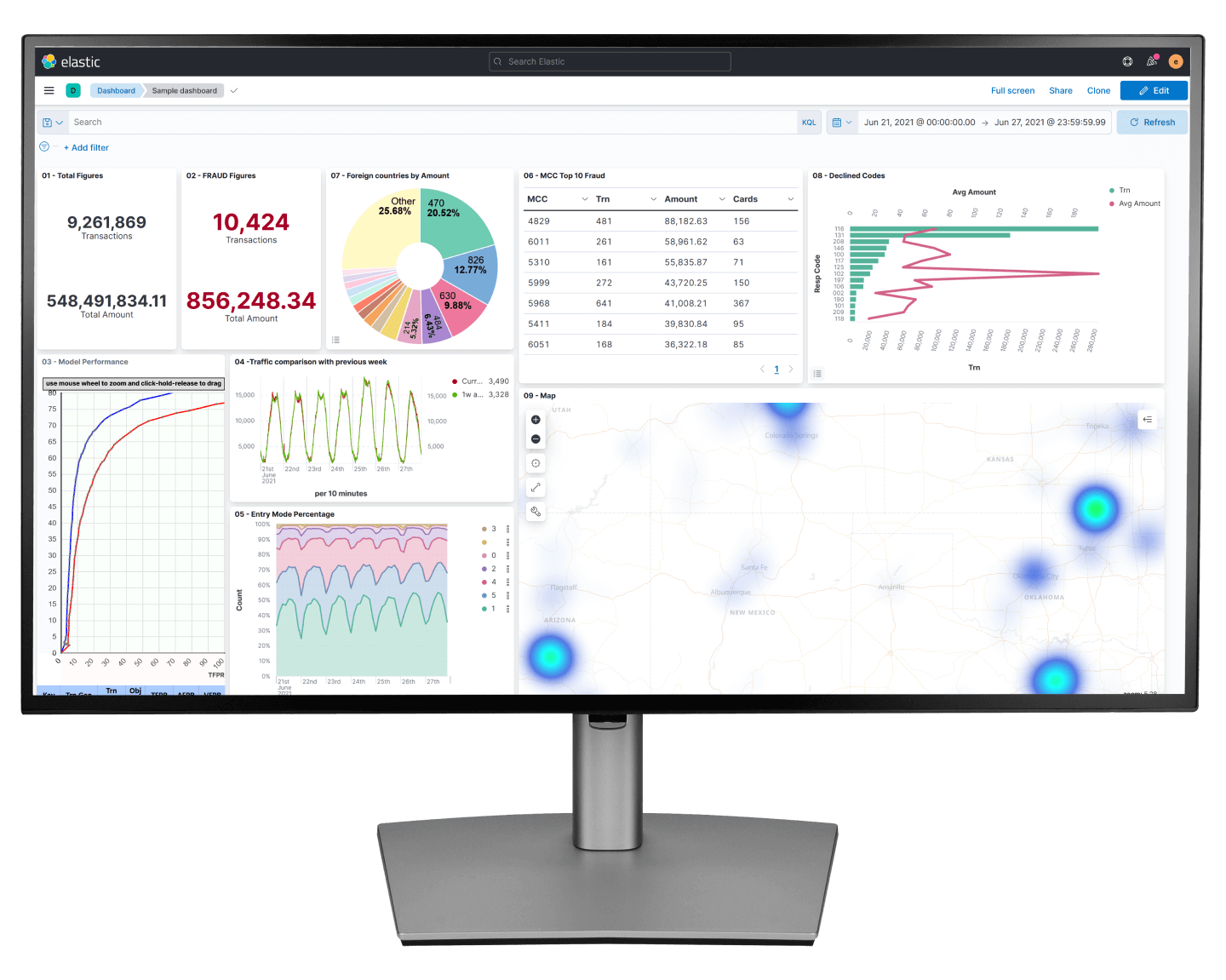

We are pleased to announce Dan Dica has been appointed the new CEO of Lynx. Lynx is a software company that specializes in AI-based fraud and financial crime prevention solutions.Dan will oversee Lynx’s businesses to take them to new heights growth and global success, turning Lynx into a global leader in AI for fraud and financial crime prevention. […]