A...

Confront the Money Mule Crisis Today

Financial institutions are at risk as money mules launder illicit funds, with over $3.1 trillion flowing through the system. Avoid becoming a statistic—Lynx provides AI-powered solutions to identify and disrupt these activities in real time, protecting your bottom line and ensuring compliance.

%

Transactions processed in ~50 ms*

Flexibility

Rapidly integrate new channels to stay agile.

%

Annual savings realized by clients.

%

Minimize losses before they affect your bottom line.

%

Global transactions protected annually.

%

Users protected annually.

Lynx has been recognized as a Leader in Next-Gen Scam Prevention by Datos Insights. Our Daily Adaptive Models empower financial institutions to meet real-time demands while combating emerging threats head-on.

Partnering with a leading UK bank, Lynx tackled a staggering €7 Million annual loss from money mules.

65% ADR

Money mule account detection rate.*

70% VDR

Successfully intercepted money mule transactions.*

10

False Positives out of 10,000 transactions. *

* Results may vary based on clients’ data quality.

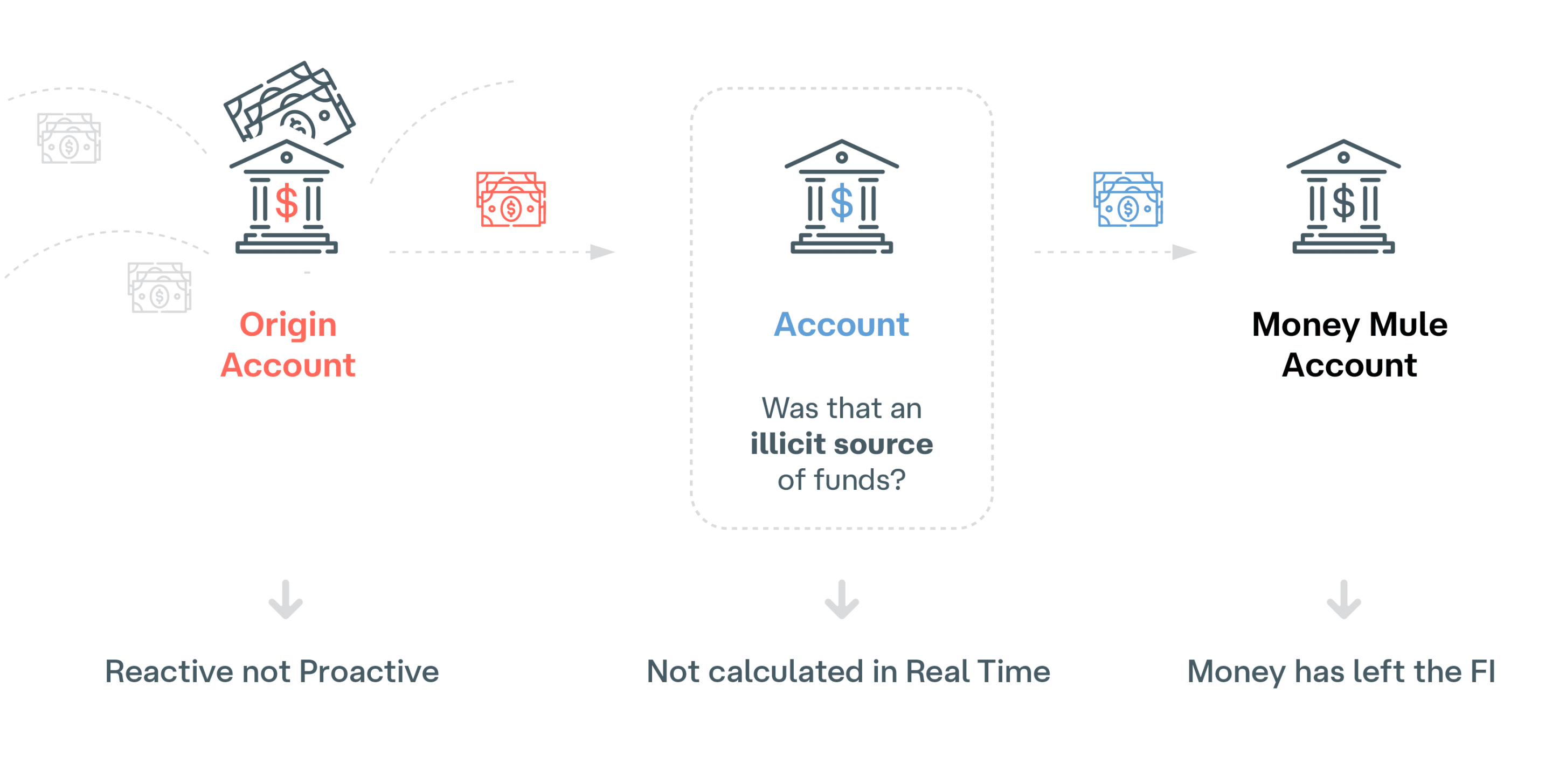

Money muling has reached crisis-level proportions. Sophisticated organized crime groups are increasingly opening, compromising, and recruiting money mule accounts to launder funds tied to authorized push payment fraud (APPF), human trafficking, and drug trafficking. To effectively address these threats, financial institutions must have real-time capabilities to detect and halt illegal activities without delay.

Money muling poses immediate challenges that demand urgent solutions. Many legacy systems contribute to high false positives, leading to significant operational challenges:

Analysts sifting through numerous alerts, hindering focus on genuine threats.

Inaccurate identification results in considerable losses for institutions and customers.

Overloaded systems lead teams to overlook critical fraud attempts.

Non-compliance with emerging AML regulations exposes institutions to penalties and reputational damage.

Outdated detection systems lead to high false positives and critical regulatory repercussions.

· 90% of money mule transactions linked to cybercrime.

· 75% of digital banking fraud attributed to APPF.

· $5.25 billion projected APPF losses by 2026 across major markets.

Real-time solutions, designed for real-time detection and regulatory compliance.

Stopping Money Mules Before They Strike: Addressing Key Threats with Real-Time Solutions.

The threat of money mules is escalating, but Lynx is here to combat these challenges with intelligence and speed.

Problem: Illicit funds from criminal activities, including APPF, human trafficking, and drug trafficking, flow through financial systems unchecked. Legacy solutions often struggle with high false positives, exposing institutions to significant risks.

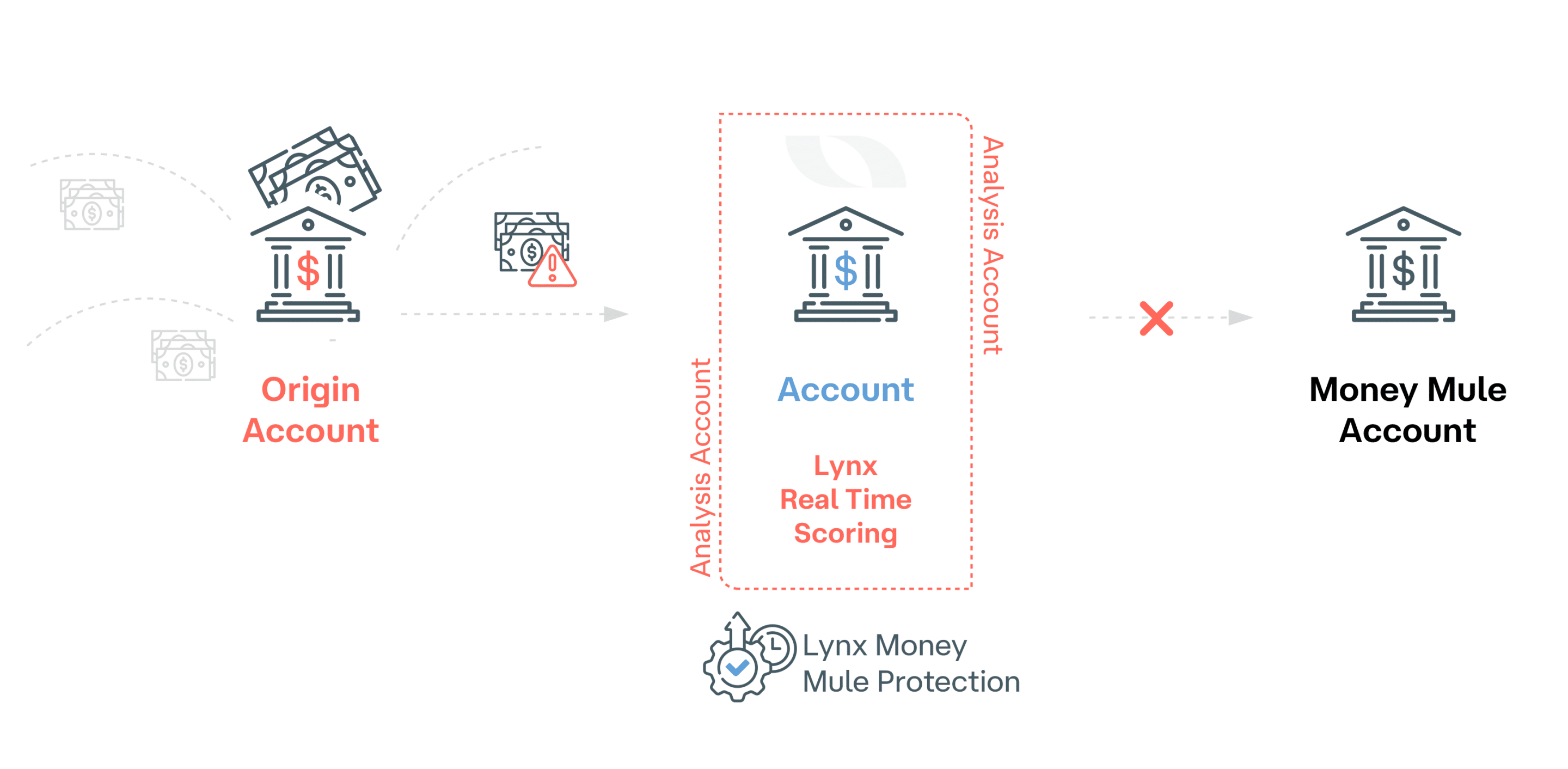

Solution: Lynx’s AI-driven models analyze incoming transactions in real time, instantly identifying suspicious patterns. This proactive approach enables you to block illicit funds before they circulate within your organization, enhancing compliance and protecting your reputation.

Solution: Our detection models proactively analyze login behavior, transaction history, and account activity to swiftly identify suspicious behavior and halt mule activities.

Solution: Lynx employs machine learning algorithms to identify alterations in transaction behavior and unusual multi-channel activities, facilitating rapid intervention.

Solution: Our Daily Adaptive Models uncover fraudulent onboarding attempts by analyzing comprehensive datasets, enabling institutions to thwart malicious activities before they escalate.

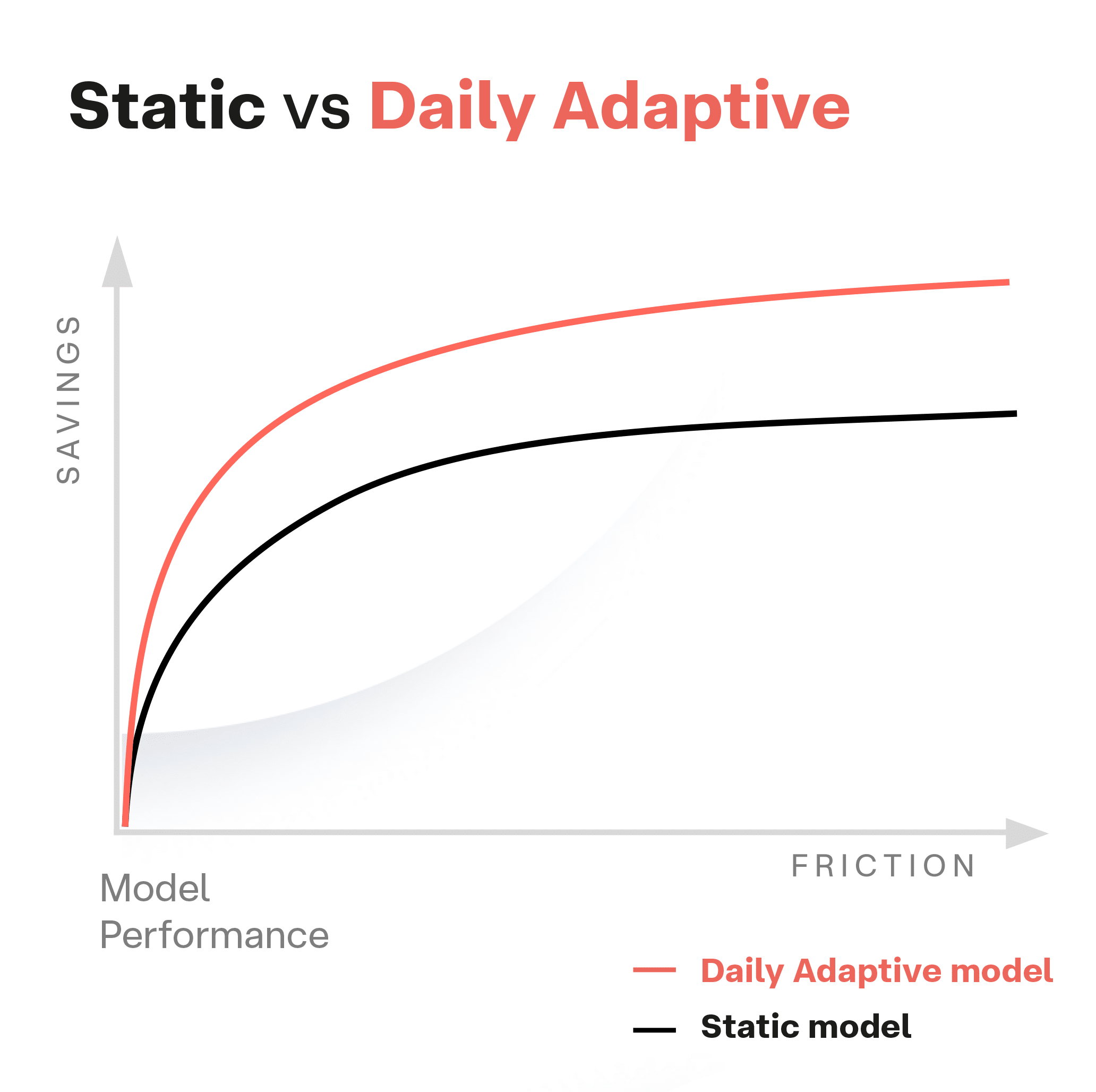

Daily Adaptive Models: Advanced AI for Real-Time Decisions

Lynx’s Daily Adaptive Models (DAMs) are designed for adaptive detection and enhanced performance, making us a leader in the financial crime prevention landscape.

For more on DAMs, check out our Daily Adaptive Models White Paper.

Seamless Integration and Flexibility

Lynx can operate as a standalone module or layer seamlessly onto existing fraud detection systems. This flexibility enhances your overall strategy without disruption, allowing for rapid deployment and immediate results.

Add new channels in less than 60 minutes, enabling you to respond quickly to evolving fraud tactics.

Lynx supports all channels, including online, mobile, card-present, and card-not-present, effectively monitoring every transaction facet.

Our algorithms offer real-time adaptability, significantly reducing false positives for more efficient fraud detection.

Evaluate all incoming and outgoing transactions in real-time, blocking illicit funds without interrupting legitimate activity, ensuring compliance and trust.

Effortlessly detect money muling activities across all channels. With Lynx Flex, easily integrate new data sources with a simple click for comprehensive coverage.

Gain a holistic perspective of money mule risks across incoming and outgoing transactions, enhancing decision-making and threat response.

Seamlessly integrate with various systems using our versatile support, including TCP/IP Socket and RESTful API.

Utilize our in-memory database for enhanced detection without incurring additional licensing fees, simplifying management through a no-code interface.

Lynx’s dynamic feedback loop continuously adapts detection capabilities based on new data, keeping you at the forefront of evolving threats.

Lynx’s models are tailored to fit your organization’s architecture, adapting to the latest patterns of money mule activities.

PCI-DSS Compliant

PCI-DSS compliant to ensure card, eBanking, mBanking and transaction data security.

ISO 27001 Compliant

ISO 27001 compliant ensuring our solutions are aligned to information security management best practice and global standards.

SOC2 Compliant

Lynx applies the strongest data management applicable keeping your data secure, available and private.

Access our articles, white papers, and insights to understand how Lynx empowers financial institutions every day.

Beyond the Transaction: Why Fraud Vigilance Is Essential for Stability

4 Ways to Stop Money Mules

Preventing Money Mules in Banking

Money Mules Revealed

Lynx Launches Money Mule Account Detection Tool

Money Mule Detection

2024 Financial Crime Predictions Unveiled!

The convergence of Fraud, AML and Cyber Security

With Lynx, you can witness the difference through a Proof of Concept (POC). In just three weeks, you can implement our solution, layer it over current systems, and observe immediate results. This rapid deployment is essential for organizations striving to comply with APPF regulations and enhance their defenses against money mule schemes without disrupting existing workflows.

No other solution offers the agility and performance of Lynx Money Mule Detection. Our unique capabilities ensure you not only meet compliance requirements but also significantly bolster your defenses against sophisticated fraud attacks.

Transform Your Money Mule Detection in Just 3 Weeks! Discover how effective our solution can be! With Lynx, you can seamlessly integrate our system and see immediate results. Our rapid Proof of Concept (POC)—implemented without any disruption to existing workflows—will help you comply with APPF regulations while strengthening your defenses against money mules.